Due to investor requirements, we are currently providing Cx14078 (AIR Verification of Receipt of Appraisal) and 15224, in which the borrower is informed that they will be provided with copies of their appraisals no less than three business days before closing, but that they may waive this timing requirement and elect to receive these copies at closings.

These documents have been provided due to Section III of Fannie Mae’s “Appraiser Independence Requirements” (AIR). Investors have required our AIR Verification of Receipt of Appraisal, to ensure that lenders have properly given copies of the appraisals at the appropriate times, as well as to have documentation of whether the borrower waived or not the timing requirements for receiving copies.

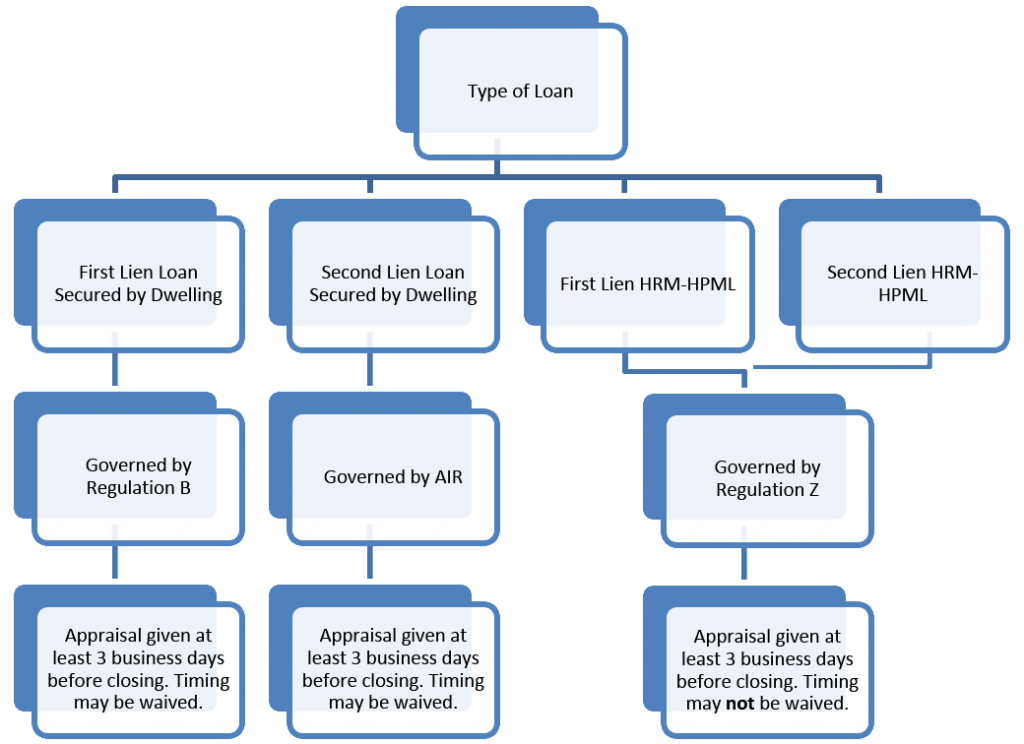

While the AIR is still applicable and in-force by Fannie Mae, it is superseded by the new appraisal requirements under Regulation B (12 CFR § 1002.14) and Regulation Z (Ibid. § 1026.35[c]) for first lien loans and higher-risk mortgages (HRM-HPMLs), respectively. In essence, this means that different requirements apply to different loans, as illustrated in the following chart:

Due to these requirements, we have created two new documents (Cx18182 and 18183), which will print dynamic text to match these various requirements, and will replace Cx14078 and 15224. The content of Cx18182 is discussed in this article, while the content of Cx18183 is discussed in a corresponding one.

Second Lien Appraisal Receipt Form (Cx18182)

This document will be used to conform with the appraisal requirements of Regulation Z (for second lien HRM-HPMLs) and the AIR (for regular second lien loans). It will print when:

1. “Application Taken On or After 01/18/2014” equals “Yes”;

2. “Document Package Type” equals one of the following:

a. Initial Disclosure

b. Appraisal

c. TILA Redisclosure

d. Closing

3. “Lien Position” equals “SecondLien”; and

4. “Print Appraisal/AVM Waiver/Receipt Form” equals “Yes.”

The text of the document will differ in depending on which package it prints in and whether the loan is a regular or higher-risk one.

Initial Disclosures

For regular second lien loans, the text in the Initial Disclosure package will be substantially similar to that of Cx15224. It discloses that the AIR requirements concerning the borrower receiving a copy of the appraisal report conducted on the subject property no later than 3 business days prior to closing and that the borrower may waive this timing requirement. It then contains selections for the borrower to elect either to receive the report according to the AIR timing requirements, or to waive such requirements and receive the report at closing.

For HRM-HPML second lien loans, there will only be a disclosure informing the borrower that they will receive their appraisal report(s) no later than 3 business days before closing. Due to 12 CFR Pt. 1026, Supp. I, Paragraph 36(c)(6)(ii) – (3), no waiver language will be included, since the borrower may not waive the timing requirements imposed under Regulation Z.

Appraisal and TILA Redisclosure

For regular second lien loans, the text in the Appraisal and TILA Redisclosure packages will be substantially similar to that in the Initial Disclosure-version, except that the selection-language will apply to subsequent appraisals and there will be language in which the borrower acknowledges receipt of any appraisal report received by the date they indicate in the form.

For HRM-HPML second lien loans, the language will also be similar to the Initial Disclosure-version, except there will be an area for the borrower to acknowledge receipt of any appraisal reports received by the date they indicate in the form.

Closing

For regular second lien loans, the text in the Closing package version will be substantially similar to the other versions, except that the selections will indicate whether the borrower elected to receive a copy of the appraisal according to the AIR, or whether they elected to waive such requirement, as well as language in which the borrower indicates that they received a copy of the report according to their selection.

For HRM-HPML second lien loans, the text in the Closing package version will also be substantially similar to the other versions, but there will be an area for the borrower to acknowledge that they received a copy of all reports at least three business days prior to closing.

Effective Date

This new disclosure is now available in the ConformX Production environment. If you have any questions or concerns about this change, please contact Client Support at 1.800.497.3584.

DR 143958

January 15, 2014