As explained in further detail in our article entitled “Agriculture is the Foundation of Manufacture and Commerce . . . and Housing?”, the USDA is implementing new regulations to replace current regulations, effective September 1, 2014. These changes not only affect the content of documents we provide, but also several system settings.

Due to these changes, we will be making the following modifications:

New Date Field

A key part of the transition between the old and the new regulations is when the loan application package is sent to the USDA for processing, as explained in the following extract from the “Frequently Asked Questions” document found on the USDA’s website:

“Question: For a mortgage loan application in process is there a version for loan requests developed under the present rule 1980-D vs. the new rule 3555?

Response: For loans in process, complete loan applications received prior to September 1 (the implementation date of the new rule) will be processed under the existing rule, 1980-D. Complete applications received on or after September 1, will be subject to the new rule, 3555.”

During this transition, some loan packages will need to include current Rural Development (RD) documents, while some others will need to include the newer forms. To accommodate this, we will be creating a new date field entitled “Date Application Package Submitted to USDA/RD” and a new global, optional prompt used for specifying when the package will be submitted to RD. This prompt will trigger when:

- “Date Application Package Submitted to USDA/RD” is empty;

- “Document Package Type” equals either “Initial Disclosure” or “Closing”; and

- “Loan Type” equals “RD.”

New Document Print Trigger

In connection with the new date field, we will be adding a new document trigger field “Use USDA 3555 Forms Effective 09/10/2014” (Field 81968) that will be set as follows:

- The field will be set to “Yes” if any of the following applies:

- “Date Application Package Submitted to USDA/RD” has a value, which is “09/01/2014” or later.

- “Date Application Package Submitted to USDA/RD” is empty, but “Application Date” has a value and is “09/01/2014” or later.

- “Date Application Package Submitted to USDA/RD” is empty and “Application Date” is empty, but “Today’s Date” is “09/01/2014” or later.

- The field will be set to “No” if any of the following applies:

- “Date Application Package Submitted to USDA/RD” has a value, which is earlier than “09/01/2014.”

- “Date Application Package Submitted to USDA/RD” is empty, but “Application Date” has a value, which is less than “09/01/2014.”

- “Date Application Package Submitted to USDA/RD” is empty and “Application Date” is empty, but “Today’s Date” is less than “09/01/2014.”

Modification to Global Data Integrity Error

Under current regulations, the term of the loan “shall be not less than 30 years from the date of the note and not more than 30 years from the date of the first scheduled payment.” (7 CFR § 1980.321). Currently, Global Error 73289 appears in ConformX when the term of the loan is outside of this range and warns the loan officer of this fact (see our announcement about this warning here).

However, under the new regulations, the only restriction in this regard is that “the term of the loan may not exceed 30 years. Adjustable rate mortgages, balloon term mortgages or mortgages requiring prepayment penalties are ineligible terms” (Ibid. § 3555.104[b]). This means that the loans can be for a term shorter than 30 years, but they must be fully amortizing and, in accordance to Subsection 104(c), the payments for the loan must be made monthly.

We will, therefore, be amending the text of Global Error 73289 so that it states the following:

“Per 7 CFR § 3555.104(b) & (c), RD/USDA loans must have fully amortizing fixed monthly payments and the loan term cannot be longer than 30 years.”

We will also be modifying the triggering conditions for this error. Most of the conditions will remain the same, but instead of triggering for all RD loans when the terms of the loan are less than 357 months, the error will now only trigger when the terms of the loan are less than 357 months and “Use USDA 3555 Forms Effective 09/01/2014” is No.

New Forms

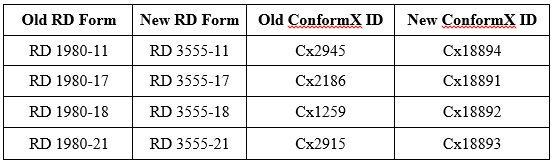

Of all the 1980-series of Rural Development forms prescribed by the USDA, we only provide five through our system (RD 1980-11, 1980-17, 1980-18, 1980-19, & 1980-21). Four of these five forms will be replaced by the new 3555-series of forms, the suffix numbers of which match those of the current 1980-series.

During the transitional period between the old and the new regulations, both versions of the forms will be supported:

All eight of these documents will, among their other configurations, be triggered to print based on “Use USDA 3555 Forms Effective 09/10/2014″, which is set as described above.

The new 3555-series will be triggered to print based on the same conditions as their predecessors (including custom configurations, “Do Not Print” settings, etc.), except for the following changes:

- RD 3555-17 (“Loan Note Guarantee”), like RD 1980-17, will continue to print as a generic document for the time being, but unlike its predecessor, it will be configured to print only in Closing packages. In addition, this document is the official loan guarantee document and, as such, is only used by RD (see RD Handbook HB-1-3555, ch. 16 for details). Despite this fact, this document is included in document packages by many clients. We will be contacting clients who have printed this form over the previous 90 days to determine the reasons for why it is being provided in their packages, in order to decide whether to continue providing this form on a generic basis or not. Clients who wish to continue having this document print are encouraged to contact their Account Manager about this matter.

- RD 3555-21 (“Request for Single Family Housing Loan Guarantee”) is required to be provided by lenders to the RD, in order to obtain a loan guarantee (see RD Handbook HB-1-3555, ch. 10 & 15 for details). Unlike RD 1980-21, we will be providing RD 3555-21 as a generic document, which will print in both Initial Disclosure and Closing packages.

Updates to Current Forms

We have also audited our other standard (or commonly used) RD forms and will be updating the following documents to more closely match the model forms which they duplicate:

- RD Form 1908-19 (Cx3178) – “Guaranteed Loan Closing Report”. Incidentally, this is one form from the 1980-series which is not being replaced by a corresponding 3555-series form.

- RD Form 410-9 (Cx2862) – “Statement Required By the Privacy Act”.

Of most importance, RD requires two specific paragraphs to be used in security instruments for loans secured by a leasehold estate (see RD Handbook HB-1-3555, ch. 16 & Att. 16-B). The two paragraphs are as follows:

“All Borrower’s right, title, and interest in and to the leasehold estate for a term of _____ years beginning on ______, 20___, created, executed and established by certain Lease dated _______, 20____, by ______________, Page ________ of ________ Records of said ______ and State, and any renewals and extensions thereof, and all Borrower’s right, title, and interest in and to said Lease, covering the following real estate.”

“Borrower will pay when due all rents and any and all other charges required by said Lease, will comply with all other requirements of said Lease, and will not surrender or relinquish any of Borrower’s right, title, or interest in or to said leasehold estate or under said Lease while this instrument remains in effect.”

The first paragraph must be “placed directly before the legal description of the real estate” in the security instrument. The fields that should populate in the first paragraph are (in order):

- 82103 “Leasehold Agreement Term in Years”

- 82104 “Date Leasehold Agreement Takes Effect”

- 32414 “Leased Date”

- 82105 “Parties to Leasehold Agreement”

- 82106 “Lease Recorded In”

- 1754 “Recording Jurisdiction Type”

Our standard documents for RD loans are duplicates of the FNMA uniform security instruments. To accommodate these paragraphs, we will be modifying the RD-version of these instruments in the following ways:

- The first paragraph will print directly above the legal description. To accommodate recording districts which do not use volumes for recording, the text “Page ______ of _________” will instead be replaced with field 82106 “Lease Recorded In,” into which clients can specify which record the lease is recorded in (e.g. “Microfilm No. XXXX”).

- The second paragraph will replace the leasehold language by FNMA, usually found in Uniform Covenant #9.

- For the Maine and New York instruments, the language of the paragraphs will be slightly altered so that they conform with the “plain language” format required for both instruments (i.e. the narrative will be changed from third-person to first-person).

- The footer for each instrument will contain the caption “Modified for RD” in order to identify the document as being a modification to FNMA’s uniform security instrument.

Since this text does not substantially alter the provisions of the security instrument, we will not be configuring it to print based off of the “Date Application Package Submitted to USDA/RD” field, but it will begin appearing as of the effective date of these changes.

Effective Date

The effective date for these changes is August 22, 2014. If you have any questions or concerns, please contact Client Support at 1.800.497.3584.

August 15, 2014

DR 155646 and DR 155836

Update:

Cx3818 (Lender Certification for SFH Guaranteed Loan) has been updated to mirror the “Lender Certification for SFH Guaranteed Loan” section of Cx18892 (Conditional Commitment for SFH Loan Guarantee – RD 3555-18). This change will take effect on March 4, 2015.

February 25, 2015

DR 166143