By: Timothy A. Raty, Sr. Regulatory Compliance Specialist

***DISCLAIMER***

Nothing in this article is to be construed as legal advice.

The Nature of a Trust – Part I

“A trust . . . is a fiduciary relationship with respect to property,

arising from a manifestation of intention to create that

relationship and subjecting the person who holds title to the

property to duties to deal with it for the benefit of charity or for

one or more persons, at least one of whom is not the sole trustee.”

-Restatement (Third) of Trusts § 2 (2003)

A trust is a fiduciary relationship between three parties, for the purpose of managing property:

- A settlor (aka trustor, grantor, transferor, and testator). This is the person who creates the trust. It is the person who originally has ownership interest in the trust property, but who places it under the care of a trust.

- A trustee. This is the person who holds the trust property in the trust and manages its care.

- A beneficiary (aka cestui que trust). This is the person in whose benefit the trust property is held in trust.

(see Restatement [Third] of Trusts § 3 [2003])

The following example illustrates a classic purpose of a trust:

Example # 1

John and Mary own a duplex, which they rent to two different tenants. However, they would like to use the income from this property to finance their nephew George’s education. In order to save on taxes, they create a trust called the “Oxford or Bust! Trust” and place the duplex into the trust. George’s father, Lee, is appointed the trustee, with instructions to manage the property and save the rental income to fund George’s education.

In this example, John and Mary are the settlors; Lee is the trustee; George is the beneficiary.

The details concerning the trust relationship are set forth in the trust documents. Trusts can be simple and involve only two people, or they may be very complex involving a dozen or so people. The individuals involved with the trust could have one role or they can have several.

Example # 2

The same as Example # 1, except that instead of appointing George’s father, Lee, as trustee, John and Mary assume the responsibilities as trustees. In this case, John and Mary are both the settlors and trustees of the “Oxford or Bust! Trust”, while George is the beneficiary.

Because the purpose of a trust is to establish a fiduciary relationship for the management of the trust property by someone for the benefit of another, by its nature, a sole trustee cannot be a sole beneficiary. As more succinctly put by the Restatement (Third) of Trusts:

“The settlor or the trustee, or both, may be beneficiaries; but a sole trustee may not be the sole beneficiary . . . Thus, the trustee must hold property for the benefit of one or more persons, at least one of whom is not the sole trustee . . . and whose interests will suffice to prevent merger when the trustee is also a beneficiary, regardless of whether those interests are present or future, vested or contingent.” (§ 3)

In the mortgage loan industry, there are two main types of trusts to which a loan is granted: inter vivos revocable trusts and land trusts.

Inter Vivos Revocable Trusts

“inter vivos trust (in-tər vi-vohs or vee-vohs) (1921) A trust that

is created and takes effect during the settlor’s lifetime.”

– TRUST, Black’s Law Dictionary (10th ed. 2014)

An “inter vivos revocable trust” is a special type of trust that remains in effect during the settlor’s lifetime, but may also be revoked by the settlor in accordance with the terms of the trust documents (typically “at will”). These types of trusts serve several functions, including providing tax-advantages, a smooth transfer of property if a settlor dies (as opposed to going through probate), and providing benefits to a minor. A decent overview is provided by the Official Staff Commentary to Federal Regulation Z (albeit it applies to all “trusts for tax or estate planning purposes,” rather than just inter vivos revocable trusts):

“. . . Consumers sometimes place their assets in trust, with themselves or themselves and their families or other prospective heirs as beneficiaries, to obtain certain tax benefits and to facilitate the future administration of their estates. During their lifetime, however, such consumers may continue to use the assets and/or income of such trusts as their property. . . .” (12 CFR Pt. 1026, Supp. I, Paragraph 3[a] – 10.i)

In the mortgage industry, it is typical to find that most of these types of trusts are made by married couples, who play the parts of settlor, trustee, and beneficiary. Note that in this regard, there is not an issue about the validity of the trust from the perspective of a party acting as both trustee and beneficiary, because there are at least two trustees and/or beneficiaries.

Land Trusts

“land trust (1828) 1. A land-ownership arrangement by which a

trustee holds both legal and equitable title to land while the

beneficiary retains the power to direct the trustee, manage

the property, and draw income from the trust. – Also termed

Illinois land trust; naked land trust”

– TRUST, Black’s Law Dictionary (10th ed. 2004)

Another common type of trust (used predominantly in Illinois) is a “land trust.” This type of trust is unique in the fact that actual title to the property is conveyed by the settlor to the trustee (who, in mortgage transactions, is typically the creditor). However, the beneficiary (who, quite often, is also the settlor) has the power to direct the trustee in the management of the property. Some of the benefits of a land trust include privacy for the owner (since any recorded documents will only make reference to the trustee, as title owner of the property) and ease of conveyance of interest in the property (since it is basically converted from real property to personal property).

The Illinois Department of Financial & Professional Regulation has an excellent overview of the basics of a land trust (see http://www.idfpr.com/banks/consumer/tips/TRUSTS.ASP) and Illinois’ statutes governing land trusts can be found in 765 Ill. Comp. Stat. Ann. Acts 405 through 435. Again, the Official Staff Commentary to Regulation Z provides a decent overview of a land trust:

“In some jurisdictions, a financial institution financing a residential real estate transaction for an individual uses a land trust mechanism. Title to the property is conveyed to the land trust for which the financial institution itself is trustee. The underlying installment note is executed by the financial institution in its capacity as trustee and payment is secured by a trust deed, reflecting title in the financial institution as trustee. In some instances, the consumer executes a personal guaranty of the indebtedness. The note provides that it is payable only out of the property specifically described in the trust deed and that the trustee has no personal liability on the note. . . .” (12 CFR Pt. 1026, Supp. I, Paragraph 3[a] – 10.ii)

Regulation Z Disclosures and Trusts – Part II

“. . . deference is especially appropriate in the process of

interpreting the Truth in Lending Act and Regulation Z. Unless

demonstrably irrational, Federal Reserve Board staff opinions

construing the Act or Regulation should be dispositive . . .” (Ford

Motor Credit Co. v. Milhollin, 444 U.S. 555, 565 [1980])

Disclosures provided under Regulation Z are required to be provided to a “consumer” in a credit transaction (e.g., see 12 CFR §§ 1026.5[a][1][ii], 1026.17[a][1], 1026.19[e][1][i], [f][1][i], & [g][1], and 1026.31[b]). A “consumer” is defined under Regulation Z as follows:

“Consumer means a cardholder or natural person to whom consumer credit is offered or extended. However, for purposes of rescission under §§ 1026.15 and 1026.23, the term also includes a natural person in whose principal dwelling a security interest is or will be retained or acquired, if that person’s ownership interest in the dwelling is or will be subject to the security interest.” (Ibid. § 1026.2[a][11]; emphasis in original)

A key element in this definition is “natural person,” which, unless otherwise specified, is an individual human being. However, the Official Staff Commentary to Regulation Z “otherwise specifies” as follows:

“Credit extended to land trusts, as described in the commentary to § 1026.3(a), is considered to be extended to a natural person for purposes of the definition of consumer.” (12 CFR Pt. 1026, Supp. I, Paragraph 2[a][11] – 3)

At first glance, this would appear to hold that only trusts which are considered a “natural person” are “land trusts.” However, the Commentary cross-referenced in this provision provides the following description of what a “land trust” is:

“Credit extended for consumer purposes to certain trusts is considered to be credit extended to a natural person rather than credit extended to an organization. Specifically:

i. Trusts for Tax or Estate Planning Purposes.

In some instances, a creditor may extend credit for consumer purposes to a trust that a consumer has created for tax or estate planning purposes (or both). Consumers sometimes place their assets in trust, with themselves or themselves and their families or other prospective heirs as beneficiaries, to obtain certain tax benefits and to facilitate the future administration of their estates. During their lifetimes, however, such consumers may continue to use the assets and/or income of such trusts as their property. A creditor extending credit to finance the acquisition of, for example, a consumer’s dwelling that is held in such a trust, or to refinance existing debt secured by such a dwelling, may prepare the note, security instrument, and similar loan documents for execution by a trustee, rather than the beneficiaries of the trust. Regardless of the capacity or capacities in which the loan documents are executed, assuming the transaction is primarily for personal, family, or household purposes, the transaction is subject to the regulation because in substance (if not form) consumer credit is being extended.

ii. Land Trusts.

In some jurisdictions, a financial institution financing a residential real estate transaction for an individual uses a land trust mechanism. Title to the property is conveyed to the land trust for which the financial institution itself is trustee. The underlying installment note is executed by the financial institution in its capacity as trustee and payment is secured by a trust deed, reflecting title in the financial institution as trustee. In some instances, the consumer executes a personal guaranty of the indebtedness. The note provides that it is payable only out of the property specifically described in the trust deed and that the trustee has no personal liability on the note. Assuming the transactions are primarily for personal, family, or household purposes, these transactions are subject to the regulation because in substance (if not form) consumer credit is being extended.” (Ibid. Paragraph 3[a] – 10)

This description incorporates both “land trusts” and “trusts for tax or estate planning purposes” – which includes (but is not limited to) inter vivos revocable trusts – as entities which are to be considered “natural persons.” At the time of this writing, the CFPB is enacting clarifying amendments to Ibid. Paragraph 2(a)(11) – 3 “to clarify that, in addition to credit extended to land trusts, credit extended to trusts established for tax or estate planning purposes is also considered to be extended to a natural person for purposes of the definition of consumer in § 1026.2(a)(11), consistent with comment 3(a) – 10.” (82 FR 37661 [2017])

This being the case, any provisions under Regulation Z applicable to a “consumer” will apply to land trusts and revocable trusts – which leads to some very interesting scenarios.

Regulation Z Disclosures – To Whom Should They Be Given

While it is clear that copies of disclosures should be provided to certain trusts, this is physically impossible because a trust is a fiduciary relationship and not a living entity to whom a piece of paper can be given. Rather, the disclosures must be provided to certain parties of the trust – the question remains as to which parties.

On this point, Regulation Z is currently silent. Although the above cited Commentary makes reference to the creditor “prepar[ing] the note, security instrument, and similar loan documents for execution by a trustee, rather than the beneficiaries of the trust” for “trusts for tax or estate planning purposes” (12 CFR Pt. 1026, Supp. I, Paragraph 3[a] – 10.i), this is in reference to contractual documents and not to disclosures.

As a matter of fact, in order for a trust to actually apply for credit, the party responsible for the management of the trust would be the one authorized to institute this action – which would be the trustee. Because a mortgage grants a creditor a secured interest in the trust property, it is necessary for the trustee to place the mortgage on the trust property (i.e. be the “mortgagor”), since the settlor and beneficiary qua settlor and beneficiary do not have the right to institute this action themselves. Since the trustee is the person who institutes these actions, it is logical to conclude that the disclosures concerning the credit terms would – at least – be provided to them. Indeed, two Federal Courts have concluded that the trustees should be given the disclosures (see Shirley v. Wachovia Mortg. FSB, No. 10-3870 SC, 2011 WL 855943, at *1 [N.D. Cal. Mar. 9, 2011] and Amonette v. IndyMac Bank, F.S.B., 515 F. Supp. 2d 1176, 1178 [D. Haw. 2007]).

Whether these disclosures should also be provided to the settlors or beneficiaries has been a matter of contention in the past, as well as whether the loan is subject to the “Right of Rescission” rules set forth under 12 CFR § 1026.23 or not. In Amonette v. IndyMac Bank, F.S.B. (see citation above), the U.S. District Court of Hawaii held that the plaintiff, as “settlor, trustee, and beneficial owner . . . ‘effectively owned the property’” and thus “her ownership interest entitles her to TILA’s protections.” However, in Shirly v. Wachovia Mortg., FSB, the U.S. District Court for the Northern District of California did not follow the decisions of this court, noting the following:

“. . . Amonette merely holds that a trustee of a revocable living trust has standing to assert TILA claims for rescission of a loan made to the trust. . . . It says nothing about the disclosure duties owed to trust beneficiaries.

Plaintiffs cite to no other law in support of their argument that Julie, as a settlor and beneficiary of the trust, was entitled to TILA disclosures separate from and in addition to the disclosures made to John, the trustee. The Court finds this argument to be unavailing. Were the law as Plantiffs wish it to be, an entity lending to a trust would be required to spend considerable time and effort identifying and notifying each trust beneficiary or run the risk of violating TILA. By making TILA disclosures to the trustee, the lender provides notice to an individual who serves as a fiduciary of the beneficiaries, and thus reasonably ensures the beneficiaries will be provided notice. The Court finds that Wachovia’s disclosure obligations extended to the trustee, John, and not to the trust’s beneficiaries or settlors.” (Ibid., No. 10-3870 SC, 2011 WL 855943, at *4 [N.D. Cal. Mar. 9, 2011])

Recently, the CFPB provided some clarity on this matter, in amendments made to Regulation Z:

“Guidance as to who should receive disclosures where credit is extended to trusts established for tax or estate planning purposes can be found in current §§ 1026.2(a)(22) and 1026.17(d) and their associated commentary. Comment 2(a)(22) – 3 provides that a trust and its trustee are considered to be the same person for purposes of Regulation Z, and comment 17(d) – 2 provides that disclosures must be given to the principal debtor and, if two consumers are joint obligors with primary liability on an obligation, the disclosures may be given to either one of them. Thus, where credit is extended to trusts established for tax or estate planning purposes, the disclosures may simply be provided to the trustee on behalf of the trust. In rescindable transactions, however, comment 17(d) – 2 provides that the disclosures required by § 1026.19(f) [the CD] must be given separately to each consumer who has the right to rescind under § 1026.23.” (82 FR 37661 [2017]; emphasis added)

More details will be covered about “ownership interest” and “Right of Rescission” rules in Part III of this series.

The Integrated Disclosures – What Should Print

On the Loan Estimate (“LE”), a creditor is required to disclose “the name and mailing address of the consumer(s) applying for the credit, labeled ‘Applicants.’” (12 CFR § 1026.37[a][5]). At the creditor’s option, signature lines for acknowledging receipt of the LE may be added to the last page, by including “a line for the signatures of the consumers in the transaction.” (Ibid. § 1026.37[n][1]) The requirements for the Closing Disclosure (“CD”) are similar (see Ibid. §§ 1026.38[a][4][i] & [s][1]).

Because certain trusts are considered “consumers” under Regulation Z, the name and mailing address of the trust must be disclosed on the first pages of the Integrated Disclosures. In addition, if signature lines are included on the LE and CD, lines must be included for the parties to the trust to whom the disclosures are provided (at the very least, the trustees).

Quite often, there are cases where one or more people are both the settlors and trustees of the trusts, and said people apply for a loan both individually and as trustee(s). In such cases, the trust is not the only “consumer” in connection with the transaction, since the individual settlor(s) are also a “natural person to whom consumer credit is offered or extended.” (Ibid. § 1026.2[a][11])

In such cases, all “consumers” and their addresses must be disclosed on the first page of the LE and CD. If there is insufficient room to disclose this information, then “an additional page” to the LE or CD may be utilized for including any extra information (see 12 CFR Pt. 1026, Supp. I, Paragraphs 37[a][5] – 1 & 38[a][4] – 1). The same is true for the signature lines (see Ibid. Paragraphs 37[n] – 2 & 38[s] – 1)

Note that the special rules concerning providing a copy of the LE or CD to “any one of them” (see Ibid., Supp. I, Paragraph 17[d] – 2) does not mean “any one trustee.” Rather, it means “any one” of the “consumers.” Thus, if the LE or CD is provided to the trust (rather than to the other consumers), it must be provided to all trustees of the trust (at least) – which in turn would necessitate including signature lines for all parties of the trust receiving a copy of the LE or CD.

Note: Since the original writing of this article, the CFPB has provided the following guidance concerning who should be listed on the first page of the LE and CD, as well as what signature lines should appear (if a creditor chooses to include signature lines pursuant to 12 CFR §§ 1026.37[n][1] & 1026.38[s][1]):

“Current comment 37(a)(15) – 1 provides guidance on how consumers’ names should be disclosed on the Loan Estimate. If there is more than one consumer applying for the credit, § 1026.37(a)(5) requires disclosure of the name and the mailing address of each consumer to whom the Loan Estimate will be delivered. Pursuant to current comment 17(d) – 2, as noted above, where credit is extended to trusts established for tax or estate planning purposes, the disclosures may simply be provided to the trustee on behalf of the trust. Therefore, to comply with § 1026.37(a)(5), a creditor may opt to disclose the name and mailing address of the trust only, although nothing prohibits the creditor from additionally disclosing, pursuant to § 1026.37(a)(5), the names of the trustee or of other consumers applying for the credit. Regarding the Closing Disclosure, current § 1026.385(a)(4) and its associated commentary provide that creditors must disclose the name and address of each consumer and seller in the transaction. . . .

Current §§ 1026.37(n) and 1026.38(s) and their associated commentary permit a creditor to determine in its sole discretion whether or not to include a signature line or insert the consumer’s name under the signature line rather than the designation ‘Applicant’ or ‘Co-Applicant.’ When credit is extended to trusts established for tax or estate planning purposes and the creditor opts to insert a signature line, nothing in the TILA-RESPA Rule prohibits the creditor from inserting the trustee’s name under the signature line along with a designation that the trustee is serving in its capacity as trustee.” (82 FR 37661 [2017])

Regulation Z “Right to Rescind” and Trusts – Part III

To make things more “interesting” under Regulation Z is the fact that the definition of “consumer” is different when the term is used in connection with the “Right to Rescind” rules set forth under 12 CFR §§ 1026.15 & 1026.23. These rules basically provide for the following:

“In a credit transaction in which a security interest is or will be retained or acquired in a consumer’s principal dwelling, each consumer whose ownership interest is or will be subject to the security interest shall have the right to rescind the transaction . . .” (Ibid. § 1026.23[a][1]; see also Ibid. § 1026.15[a][1][i])

In regards to these rules, the definition of “consumer” includes “a natural person in whose principal dwelling a security interest is or will be retained or acquired, if that person’s ownership interest in the dwelling is or will be subject to the security interest.” (Ibid. § 1026.2[a][11])

Because certain trusts are still considered “consumers” – since they are a “natural person to whom consumer credit is offered or extended” – the “Right to Rescind” applies to them under the clause “each consumer whose ownership interest is or will be subject to the security interest shall have the right to rescind the transaction” (Ibid. § 1026.23[a][1]), due to the fact that the “subject [of] the security interest” is the trust property – which the trust has an ownership interest in.

However, where the “Right to Rescind” becomes complicated is the fact that a “natural person in whose principal dwelling a security interest is or will be retained or acquired,” who also has an ownership interest in the property, has a “Right to Rescind” and must receive the “material disclosures” required under these rules. Who these persons are will vary on a case-by-case basis and will be dependent upon the facts and terms of the trust documents.

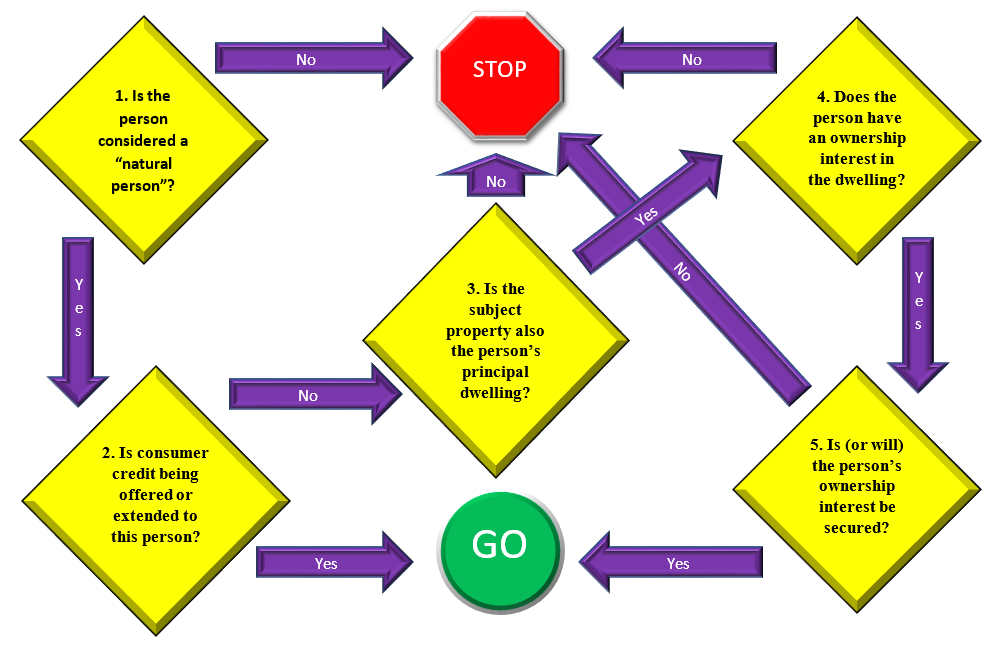

Overall, to determine whether someone has a “Right to Rescind” or not, the following steps need to be taken:

The following scenarios provide examples, ranging from simple to complex, of how the “Right to Rescind” rules apply when a trust is involved in a loan.

Scenario # 1 – “Vanilla”

Mr. and Mrs. Johnson, an elderly couple, jointly own and live in a modest home. They are approaching retirement and would like to renovate the house. Upon consultation with their attorney and accountant, they decide to create an inter vivos revocable trust, with themselves as both settlor, trustee, and beneficiary. They place title to their house into the trust, with the condition that if the trust is revoked, ownership of the house will revert to them. Once the trust is established, they obtain a cash-out refinance loan with the trust as the sole borrower and the subject property being that of the home.

In this scenario, there are three “persons” who would be considered “consumers” under Regulation Z and, as such, would be entitled to the “material disclosures” required under the “Right to Rescind” rules. These persons are:

- The revocable trust.

- Is the person considered a “natural person”? Yes. Between 12 CFR Pt. 1026, Supp. I, Paragraphs 2(a)(12) – 3 & 3(a) – 10.i, a revocable trust is considered a “natural person.”

- Is consumer credit being offered or extended to this person? Yes, the loan is being extended to the trust.

- Mr. Johnson

- Is the person considered a “natural person”? Yes.

- Is consumer credit being offered or extended to this person? While Mr. Johnson’s income and assets may be used to qualify for the loan, the proceeds of the loan are not being extended to him, but to the trust.

- Is the subject property also the person’s principal dwelling? Yes, Mr. Johnson uses the subject property as his principal dwelling.

- Does the person have an ownership interest in the dwelling? Yes. While the property itself is vested in the trust, Mr. Johnson does retain ownership interest in it, since he will resume ownership whenever the trust is revoked.

- Is (or will) the person’s ownership interest be secured? The security for the loan will be placed on the entire house, allowing the creditor to foreclose upon and potentially sell it. As such, Mr. Johnson’s ownership interest is secured by the loan.

- Mrs. Johnson – for the same reasons listed for Mr. Johnson.

Scenario # 2 – “Strawberry Swirl”

Mr. and Mrs. Johnson jointly own and live in a home with their son, Junior, who has just graduated high school and the Johnson’s want to put Junior through college. They decide to create a revocable trust for this purpose (entitled the “Junior to College or Bust! Trust”) and place several assets into it, including their home. They themselves are the settlors and trustees of the trust, but make Junior the beneficiary. Ownership of the trust property will revert to Mr. and Mrs. Johnson upon revocation. A cash-out refinance mortgage loan is extend to the Trust and is secured by the trust real property; the proceeds are used to pay Junior’s tuition.

In this scenario, three “persons” are considered “consumers.” The “Junior to College or Bust! Trust” is a “consumer” under the traditional definition of consumer (a “natural person to whom consumer credit is offered or extended”). Mr. and Mrs. Johnson are both “consumers” for the same reasons outlined in Scenario # 1. Junior, however, is not a “consumer”:

- Is the person considered a “natural person”? Yes, Junior is a natural person.

- Is consumer credit being offered or extended to this person? No, it is being extended to the Trust.

- Is the subject property also the person’s principal dwelling? Yes, Junior occupies the subject property as his primary residence.

- Does the person have an ownership interest in the dwelling? No. The subject property is vested in the Trust. Once the Trust is revoked, it will be vested in Mr. and Mrs. Johnson, rather than Junior. As such, Junior has no ownership interest in the property.

Scenario # 3 – “Neopolitan”

Mr. and Mrs. Johnson live in an estate, which Mr. Johnson owned before their marriage. They both live in the mansion, while their beloved gardener, Mr. Green, lives in the gatehouse. Unfortunately, Mr. Green has been diagnosed with cancer and must undergo expensive medical treatments. To help with these expenses, the Johnson’s establish a revocable trust (“Grass is Always Greener Trust”) and place the estate, plus a special bank account, into the Trust. Under the terms of the Trust, Mr. and Mrs. Johnson are the settlors. They nominate their butler, Ms. Penguin, to act as trustee, with Mr. Green being the beneficiary. Upon revocation of the trust, ownership of the mansion will revert back to Mr. Johnson, while ownership of the gatehouse will revert to Mr. Green (as a life estate). To finance the Trust, Mrs. Johnson pledges 10% of her net income, while a cash-out refinance mortgage loan (extended to the Trust) is secured by the trust’s real property.

Under this Scenario, the following persons are considered “consumers”:

- The Grass is Always Greener Trust, because it is a “natural person” and credit is being extended to such person.

- Mr. Johnson. While the loan is not extended to him, the mansion is his principal dwelling, he has an ownership interest in the dwelling (since ownership will revert to him upon revocation), and such interest is secured by the loan.

- Mr. Green. Similar to Mr. Johnson, the loan is not extended to him. However, part of the subject property (the gatehouse) is his principal dwelling, he has an ownership interest in the dwelling (he will have a life estate in it if the trust is revoked), and such interest is secured by the loan.

The following persons, however, are not considered “consumers”:

- Mrs. Johnson. While she is a “natural person” and the mansion is her principal dwelling, she does not have an ownership interest in the property. She did not have such interest before the trust was created (title was solely in her husband’s name) or afterwards (the estate is vested in the trust; upon revocation, ownership will be split between Mr. Johnson and Mr. Green).

- Ms. Penguin. While she is a “natural person” and the mansion is (presumably) her principal dwelling, she has no ownership interest in the property. However, because she is the trustee of the Trust, the material disclosures required under Regulation Z must be provided to her in her fiduciary capacity and, if rescission is to occur, it would be under her direction.

Scenario # 4 – “Triple Bypass Surgery Chocolate Fudge”

Father Johnson has passed away and has left his estate (which consists of two mansions, both of which can be adapted into two dwelling units [for a total of four dwelling units]) to his children. The first mansion is conveyed to two of his children, Mr. Johnson and Mrs. Smith, while the second mansion is conveyed to the other two children, Miss Johnson and Mr. Jones.

At the time of conveyance, Mr. Johnson is married to Mrs. Johnson, while Mrs. Smith was single at the time (but married Mr. Smith subsequently). Thus, Mrs. Smith has a 50% interest in the mansion, while the Johnson’s split the other 50% interest between themselves (25% each). Miss Johnson and Mr. Jones are both single, so they both hold a 50% ownership interest in the second home. The Johnsons live out of state, but the other three children live in the mansions as their primary residences.

The Johnsons decide to create a revocable trust (“The Johnson Trust”) for tax purposes. They are the settlors of the trust and hire the family lawyer (Ms. Harrison) to be the trustee. The beneficiaries are themselves and, if the trust is revoked, ownership reverts to them.

Also, Miss Johnson and Mr. Jones decide to create a revocable trust (“The Twins Trust”) to help support their mother. They place several properties into the trust, including their mansion, with themselves as settlors, Ms. Harrison as the trustee, and Mother Johnson as the beneficiary. If the trust is revoked, ownership of the trust property will revert to Mother Johnson.

The mansions are old and renovations must be done on them. To finance these renovations, both Trusts apply for a mortgage loan, which is secured solely by the trust properties.

In this scenario, only the trusts are considered “consumers” under Regulation Z (since they are “natural persons” to whom credit is extended). The other persons listed are not, for the following reasons:

- Mr. and Mrs. Johnson. While both are natural persons, credit is not extended to them. They do have an ownership interest in the mansion, which is secured by the loan (they will retain their ownership of the mansion if the trust is revoked), but it is not their principal dwelling.

- Mrs. Smith. Although she is a natural person, the mansion which she shares with the Johnsons is her principal dwelling, and she has an ownership interest in the dwelling, her ownership interest is not secured by the mortgage loan (which is only secured by the Johnson’s 50% share).

- Mr. Smith. While being a natural person and principally living in the mansion, Mr. Smith has absolutely no ownership interest in the dwelling, since he married Mrs. Smith after the property was conveyed to her and no part of her interest in the property has been conveyed to him (thus he has no community or tenancy-by-the-entirety interest).

- Miss Johnson and Mr. Jones. Both are natural persons and the mansion is their principal dwelling. However, since the mansion was conveyed into the trust and ownership will revert to Mother Johnson if it is revoked, these two no longer have any ownership interest in the property.

- Mother Johnson. A natural person who does have an ownership in one of the mansions (if “The Twins Trust” is revoked), neither of the properties are used as her principal dwelling.

- Ms. Harrison. While a natural person, the family’s lawyer does not reside in either of the properties and has no ownership interest in them. However, as trustee of the two “consumers” (the trusts), material disclosures under the “Right to Rescind” rule must be provided to Ms. Harrison and it would be under her direction that the loan is rescinded.

Signature Requirements for Trusts on Legal Instruments – Part IV

While state laws may (or may not) create nuances as to which parties to a trust need to sign which legal documents, the Federal National Mortgage Association (“FNMA”) and the Federal Home Loan Mortgage Corporation (“FHLMC”) do set forth requirements pertaining to this, thus providing some type of universal rules which can be applied in most situations and most jurisdictions.

Promissory Notes

For an inter vivos revocable trust, FNMA requires that “each trustee and each individual establishing [such] trust whose income and assets are used to qualify for the mortgage [known as a ‘credit applicant’] must separately execute the note and any necessary addendum.” (FNMA 2017 Selling Guide B8-5-02)

In most circumstances involving consumer mortgage loans, the “income . . . used to qualify for the mortgage” is that of the settlors of the trust – though it is possible for the trust to independently generate income (e.g. rental income generated through the trust property), such that a mortgage loan may exclusively be provided to the trust. In such cases, the settlor is considered a “credit applicant” and must sign the note individually and, if also a trustee of the trust, must sign it as a trustee.

Example # 1

John and Mary establish an inter vivos revocable trust (with themselves as trustee) and vest their primary residence in such trust, as the trust’s sole property. When applying for a loan on behalf of the trust to finance their nephew George’s education, the loan is underwritten using their income. As such, their income was used to qualify for the loan. They must then sign the promissory note individually, because they are considered a settlor who is also a credit applicant. Because the trust is the actual borrower, they must also sign the note as trustees.

Example # 2

The same as Example # 1, except that rather than vesting their primary residence in the trust, they vest four of their rental properties and the generated income from such, which is $2,000 a month. When applying for a loan on behalf of the trust to finance George’s education, it is determined that the income from the trust is sufficient to qualify for the loan, thus John’s and Mary’s incomes are not considered and they are not considered credit applicants. As such, John and Mary do not need to sign the note individually; they will, however, have to sign the note as trustees.

FNMA sets forth specific forms of signature blocks for use in cases where the trustee and settlor are either different entities or are the same (see Ibid. E-2-05). Note that other entities not associate with the trust may be considered “credit applicants” and must sign the note individually.

Example # 3

The same as Example # 1, except that when John and Mary apply for the loan on behalf of the trust, they are also joined by George. The income of John and Mary is used in underwriting the loan, along with the income and assets of George. In such a case, John and Mary must sign the note both individually and as trustees. George, however, only signs the note (in his individual capacity), since he is considered a credit applicant. He is not a trustee or settlor of the trust, therefore he does not sign in either of these capacities.

FHLMC promulgates similar requirements under FHLMC Single-Family Seller/Servicer Guide ch. 5103.5.

For land trusts, FNMA and FHLMC no longer provide general guidance as to which entities should sign which documents. In the past, FHLMC has stipulated that “the land trust beneficiaries must execute the Note and guarantee payment of the Mortgage.” (see FHLMC Single-Family Seller/Servicer Guide Vol. 1, ch. 22.10 [2012]) In most cases, the beneficiary of the land trust will also be the settlor of such trust, thus both the settlor/beneficiary and trustee would sign the note (based on this older requirement).

Promissory Note Addenda

Both FNMA and FHLMC promulgate rules regarding use of a signature addendum, if there is insufficient space on the note itself for all signatures. If such an addendum is used, all individual borrowers must sign the note, while trustees sign the addendum (see FNMA 2017 Selling Guide E-2-05 and FHLMC Single-Family Seller/Servicer Guide ch. 5103.5).

As for any other addenda, FNMA’s stipulates that, like the note, “each trustee and each individual establishing an inter vivos revocable trust whose income and assets are used to qualify for the mortgage must separately execute the note and any necessary addendum.” (FNMA 2017 Selling Guide B8-5-02) FHLMC does not provide similar guidance in this regard.

Security Instruments

FNMA stipulates that “the trustee(s) of the inter vivos revocable trust also must execute the security instrument and any applicable rider.” (FNMA 2017 Selling Guide B8-5-02). This is emphasized again in another part of the Selling Guide, which states that “each trustee of the inter vivos revocable trust must sign the security instrument (and any necessary rider)” using a signature block promulgated in the Guide (see Ibid. E-2-05)

In addition, “each individual establishing the trust [a settlor] whose income and assets are used to qualify for the mortgage [a credit applicant] must acknowledge all of the terms and covenants in the security instrument and any necessary rider, and must agree to be bound thereby, by placing his or her signature after a statement of acknowledgment on such documents.” (Ibid.)

Thus, it is possible for the settlor of the trust – who is also a trustee – to sign in two different parts of the security instrument: once as a trustee accepting the terms of the instrument, then once as a settlor acknowledging such terms. The form of the acknowledgment and signature block for any settlor who is considered a credit applicant is set forth in Ibid. E-2-05. These “must be added to the security instrument (and any necessary rider) following the Borrower’s Signature lines (and then must be signed by each settlor of the inter vivos revocable trust who is a credit applicant).” (Ibid.)

FHLMC has similar requirements under FHLMC Single-Family Seller/Servicer Guide ch. 5103.5.

Rider

Under FHLMC requirements, the acknowledgment required to be signed by a settlor who is a credit applicant can either be included in the security instrument, or may be included in a rider (see FHLMC Single-Family Seller/Servicer Guide ch. 5103.5 and Exhibit 9B).

FNMA requires a revocable trust rider to be used for loans extended to an inter vivos revocable trust (see FNMA 2017 Selling Guide B8-5-02 & E-2-04). Such rider must be executed by the trustees and by any other party required to sign the security instrument. It must also be acknowledged by each settlor who is a credit applicant.

For all other riders, FNMA requires that “the trustee(s) of the inter vivos revocable trust also must execute . . . any applicable rider.” (FNMA 2017 Selling Guide B8-5-02). FHLMC does not specify who should sign any riders other than the Trust Rider (see Supra).

Conclusion

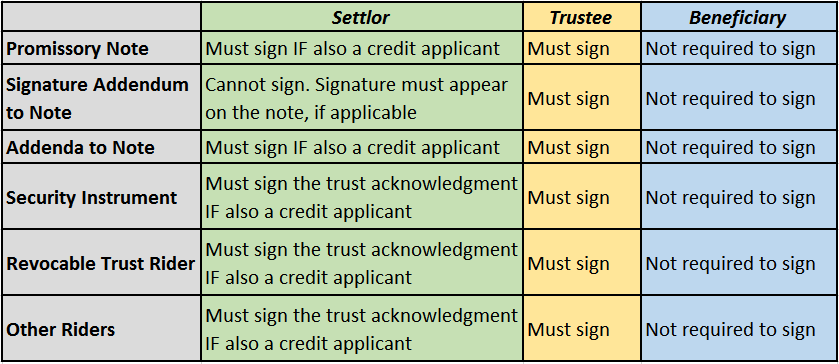

To summarize, the following entities should sign the following legal documents, when an inter vivos revocable trust is a borrower: