By: Timothy A. Raty, Sr. Regulatory Compliance Specialist

Per 12 CFR § 1026.37(o)(4)(i)(A), the dollar amounts required to be disclosed in the “Lender Credits” row of Section J of the Loan Estimate (“LE”) are required to be rounded to the nearest dollar. Rounded amounts which are a composition of other amounts are required to be calculated as follows:

“If a dollar amount that is required to be rounded by § 1026.37(o)(4)(i) on the Loan Estimate is a total of one or more dollar amounts that are not required or permitted to be rounded, the total amount must be rounded consistent with § 1026.37(o)(4)(i), but such components amounts used in the calculation must use such unrounded numbers. In addition, if any such unrounded component amount is required to be disclosed under § 1026.37, consistent with § 1026.2(b)(4), it should be disclosed as an unrounded number. If an amount that is required to be rounded by § 1026.37(o)(4)(i) on the Loan Estimate is a total of one or more components that are also required to be rounded by § 1026.37(o)(4)(i), the total amount must be calculated using such rounded amounts . . .” (12 CFR Pt. 1026, Supp. I, Paragraph 37[o][4] – 2)

The amount disclosed in “Lender Credits” is comprised solely of specific and non-specific (“general”) lender credits, per the following:

“Section 1026.19(e)(1)(i) requires disclosure of lender credits as provided in § 1026.37(g)(6)(ii). Such lender credits include non-specific lender credits as well as specific lender credits. . . .” (Ibid. Paragraph 37[g][6][ii] – 1)

“. . . ‘Lender credits,’ as identified in § 1026.37(g)(6)(ii), represents the sum of non-specific lender credits and specific lender credits. Non-specific lender credits are generalized payments from the creditor to the consumer that do not pay for a particular fee on the disclosures provided pursuant to § 1026.19(e)(1). Specific lender credits are specific payments, such as a credit, rebate, or reimbursement, from a creditor to the consumer to pay for a specific fee. . . .” (Ibid. Paragraph 19[e][3][i] – 5)

Specific credits are used to reduce or eliminate the amount imposed on a consumer for a specific service related to the loan transaction. The costs of these services are rounded and disclosed in Sections A through H of the LE. This leads to an issue of whether the rounded or unrounded amounts of specific lender credits should be added to general lender credits, to come up with the total for “Lender Credits”.

An argument in favor of rounding specific credits before adding them is based on the fact that such credits are used to offset the costs which are disclosed in Sections A through H. These costs are required to be rounded, thus the credits for them are indirectly required to be rounded as well under 12 CFR § 1026.37(o)(4)(i)(A). If they are so required to be rounded, then the rounded amounts should be used in the calculation for “Lender Credits”, per 12 CFR Pt. 1026, Supp. I, Paragraph 37(o)(4) – 2.

An argument against rounding is the fact that specific credits are not actually disclosed separately on the LE and, hence, are not required to be rounded. Ibid. Paragraph 37(g)(6)(ii) – 1 cited above does not stipulate that the component amounts of “Lender Credits” are to be gleaned from other parts of Regulation Z (i.e. it stipulates that lender credits are comprised of specific and non-specific credits, as opposed to saying it is comprised of amounts disclosed under any part of the LE). As a result, the guidance in Ibid. Paragraph 37(o)(4) – 2 concerning using unrounded amounts for components not required to be rounded applies.

As a practical matter, each method will lead to different results. To illustrate, assume that there is a loan with only two costs:

- Credit report fee of $25.50

- Appraisal fee of $449.63

The creditor is paying these costs, thus there are two specific lender credits of $25.50 and $449.63.

On the LE, the two fees are disclosed as follows:

- Credit report fee is rounded to “$26” and disclosed in Section A

- Appraisal fee is rounded to $450 and disclosed in Section B

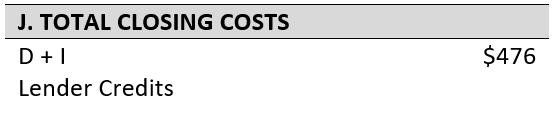

The totals of Sections A and B ($26 and $450, respectively) are added together ($476), with the sum disclosed in Section D. Sections D and I are added together ($476 and $0), with the sum disclosed in “D + I” in Section J, as illustrated below.

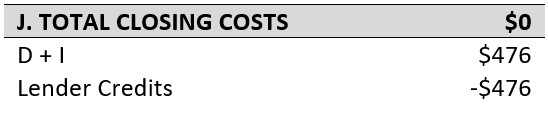

If the two credits for this loan are rounded then added together, the result would be a disclosure which indicates that the borrower has no closing costs:

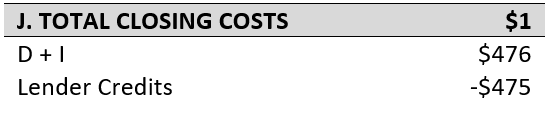

If, however, the two credits are added together using their actual, non-rounded amounts ($25.50 + $449.63 = $475.13), the result shows that the borrower owes $1 in closing costs:

Due to this predicament and the two arguments which could be made either way, we posed this issue to the Bureau of Consumer Financial Protection and asked for guidance on which way “Lender Credits” should be calculated.

Informal, verbal, non-binding feedback from staff attorneys at the Bureau indicated that because specific lender credits are not disclosed separately on the LE, the rounding rules do not apply to this component of “Lender Credits”. The actual, non-rounded specific credits must be added together as part of the calculation for “Lender Credits”, even if it results in a marginal difference between the disclosed closing costs and what the actual closing costs are.