By: Timothy A. Raty; Sr. Regulatory Compliance Specialist

“This thing is like an onion. The more layers you peel, the more it stinks.” (George Costanza, Seinfeld, Season 8: The Soul Mate)

One of the more intriguing conundrums of TRID (particularly TRID 2.0) is 12 CFR § 1026.38(j)(1)(v), which requires the following to be disclosed in the “Borrower’s Transaction” table of the Closing Disclosure (CD):

“A description and the amount of any additional items that the seller has paid prior to the real estate closing, but reimbursed by the consumer at the real estate closing, and a description and the amount of any other items owed by the consumer at the real estate closing, not otherwise disclosed pursuant to paragraph (f), (g), or (j) of this section.”

Subsection 38(j)(1) is structured in a sequential order, with each clause referring to subsequent lines in the “Borrower’s Transaction” table and (in most cases) the label to be used in each line: Subsection 38(j)(1)(i) specifically requires the “Due from Borrower at Closing” label in Line K.01; Subsection 38(j)(1)(ii) specifically requires the “Sale Price of Property” label in Line K.02; etc.

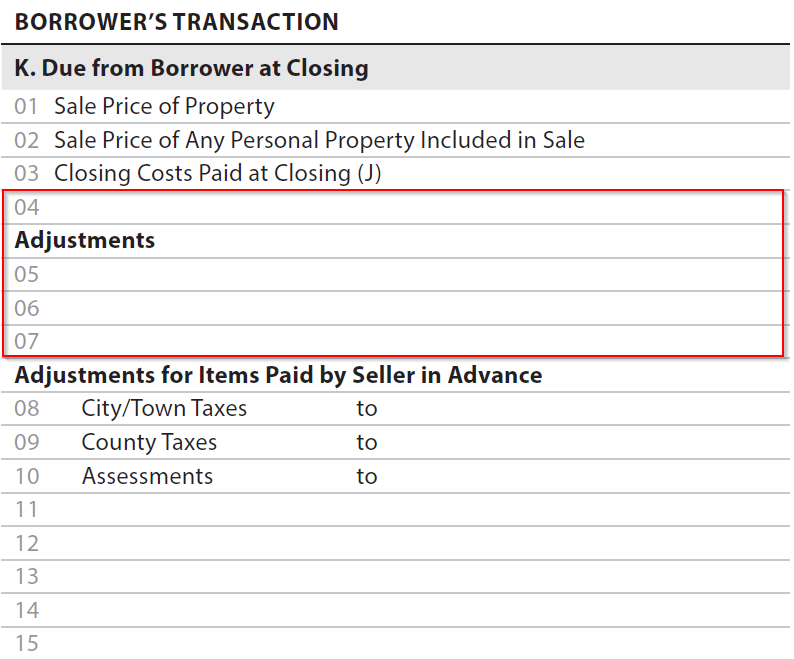

Subsection 38(j)(1)(v), however, is the goat among the sheep. It does not specify a label to be used and it appears between the subsections requiring the labels “Closing Costs Paid at Closing” (K.03) and “Adjustments for Items Paid by Seller in Advance” (K.08). A logical conclusion, therefore, is that Subsection 38(j)(1)(v) applies to Lines K.04 through K.07, as illustrated below:

This is odd, as Line K.04 has no label and Lines K.05 through K.07 appear under the label “Adjustments”. Based on this, a conclusion could be made that the regulatory structure of Subsection 38(j)(1)(v) was designed to be one requirement for two parts of Section K – a departure from the “one subsection, one part” method used in the other clauses of Subsection 38(j)(1). Line K.04 could be used for some of the types of charges described in Subsection 38(j)(1)(v) (i.e. charges which are not used for adjustments), while Lines K.05 through K.07 are used for the other types (i.e. adjustments).

Another argument could be made that Subsection 38(j)(1)(v) was meant to only apply to Lines K.05 through K.07 – particularly since the requirement focuses primarily on adjustments – but such an interpretation would leave Line K.04 without any regulatory backing, lowering it to nothing more than a spacing line which could never be used, because TRID does not authorize a disclosure in such line.

Master One: The CFPB

Focusing exclusively on the regulatory text, there are two types of charges which may be disclosed in Lines K.04 through K.07: (1) contractual adjustments; and (2) other consumer charges. Examples of these types of charges are provided in the Official Staff Commentary to Regulation Z, as follows:

“. . . For example, the following items must be disclosed and listed under the heading ‘Adjustments’ under § 1026.38(j), to the extent applicable:

i. The balance in the seller’s reserve account held in connection with an existing loan, if assigned to the consumer in a loan assumption transaction;

ii. Any rent that the consumer will collect after the real estate closing for a period of time prior to the real estate closing; and

iii. The treatment of any tenant security deposit.” (12 CFR Pt. 1026, Supp. I, Paragraph 38[j][1][v] – 1)

“. . . For example, the amounts paid to any holders of existing liens on the property in a refinance transaction, construction costs in connection with the transaction that the consumer will be obligated to pay, payoff of other secured or unsecured debt, any outstanding real estate property taxes, and principal reductions are disclosed under § 1026.38(j)(1)(v) . . .

On the simultaneous subordinate financing Closing Disclosure, the proceeds of the subordinate financing applied to the first-lien transaction may be included in the summaries of transactions table under § 1026.38(j)(1)(v). . . .” (Ibid. Paragraph 38[j][1][v] – 2 & 3)

A key provision of these Commentaries is the one which requires that contractual adjustments “must be disclosed and listed under the heading ‘Adjustments’”. This limits contractual adjustments to being listed only in Lines K.05 through K.07, thus only permitting “other consumer charges” to be disclosed in Line K.04. “Other consumer charges” are not prohibited from being disclosed under “Adjustments”, though if a creditor does so, there is a risk that the creditor would be providing an inaccurate and misleading disclosure.

Because the quantity of “other consumer charges” can be substantial, it is quite possible they cannot all fit in Lines K.04 through K.07 (particularly if one makes the argument that they should only be disclosed in Line K.04). In such instances, the Official Staff Commentary provides the following:

“Additional pages may be attached to the Closing Disclosure to add lines, as necessary, to accommodate the complete listing of all items required to be shown on the Closing Disclosure under § 1026.38(j) and (k), and for the purpose of including customary recitals and information used locally in real estate closings (for example, breakdown of payoff figures . . .) . . . A reference such as ‘See attached page for additional information’ should be placed in the applicable section of the Closing Disclosure.” (12 CFR Pt. 1026, Supp. I, Paragraph 38[j] – 2; emphasis added)

Note that additional lines may only be used “as necessary” – meaning that if the creditor has sufficient space in Lines K.04 through K.07 to disclose “other consumer charges,” the creditor must do so (though an argument could be made that a breakdown of payoff figures could be made on an addendum, regardless of spacing, because it is a “customary recital” and the “as necessary” clause does not apply to customary recitals).

While this is the extent to which Regulation Z provides guidance on Lines K.04 through K.07, the CFPB’s “TILA-RESPA Integrated Disclosure Guide to the Loan Estimate and Closing Disclosure forms” (v. 2.1; hereafter referenced as “The Guide”) provides additional (albeit persuasive, rather than authoritative) guidance.

For Lines K.05 through K.07, The Guide specifically limits these to “adjustments”, as follows:

“Under the heading Adjustments, disclose a description and amount for each of the following:

- Items not otherwise disclosed in Section K of the Closing Disclosure (i.e., items not already disclosed as Adjustments for Items Paid by the Seller in Advance) that the seller has paid prior to the real estate closing but that will be reimbursed by the consumer at closing.

- Items not otherwise disclosed in Section K of the Closing Disclosure that are owed to the seller but payable to the consumer after the closing.” (p. 92; emphasis in the original)

Thus, “other consumer charges” may only be disclosed in Line K.04, or in an addendum to the CD if there is more than one “other consumer charge.” This is also per The Guide, which states the following:

“Disclose other consumer charges owed by the consumer in the real estate closing not otherwise disclosed in the Loan Costs table, Other Costs table, or Section K of the Closing Disclosure. Generally, these amounts may be disclosed on Line K.04. Examples include:

- Amounts paid to any existing holders of liens on the Property in a refinance transaction,

- Payoffs of other secured or unsecured debt,

- Any outstanding real estate property taxes,

- Construction costs that the consumer will be obligated to pay in connection with the transaction,

- Principal reductions, and

- For a simultaneous subordinate lien loan, the proceeds of the simultaneous subordinate lien loan that are applied to the first-lien loan.” (pg. 93 – 94; emphasis in the original)

Between the actual text of Regulation Z and The Guide, a conclusion can be made that, in order to comply with TRID:

- “Other consumer costs” (g. payoffs, principal reductions, etc.) can only be disclosed in Line K.04 (and if there is more than one such cost, then an addendum to the CD may be used); and

- “Adjustments” can only be disclosed in Lines K.05 through K.07 (and if there are more than three such costs, then an addendum to the CD may be used).

Master Two: The GSEs

Despite Regulation Z being the only authority on how the CD should be formatted and completed, FNMA and FHLMC have imposed their own “extra-curricular” requirements when it comes to their Uniform Closing Dataset (UCD) requirements. According to their “Uniform Closing Dataset (UCD) Specification Appendix E: UCD Implementation Guide” (v. 1.4; hereafter referred to as “The UCD Guide”), only payoffs are permitted to be disclosed in Line K.04:

“Sometimes an exchange of funds occurring outside of the closing transaction must be disclosed. When a borrower must pay off an external liability(ies) as a condition of receiving the loan, the line item is disclosed as 11.4 [Line K.04] and identified in the XML document by the value of LiabilityType.

Examples include, but are not limited to:

1. Payoff of existing lien(s) secured by the property, such as mortgages, deeds of trust, judgments that have attached to the real property, mechanics’ and materialmen’s liens, and local, State and Federal tax liens;

2. Payments of the borrower(s) unsecured outstanding debts; and

3. Payments to third parties for the borrower(s) outstanding debts (but not for settlement services) as a condition of receiving credit. . . .” (pg. 166 – 167)

As a result, “adjustments” and any “other consumer charges” which are not considered payoffs would need to be disclosed in Lines K.05 – K.07. This is exactly outlined in The UCD Guide as follows:

“Non-prorated items for which the Borrower is reimbursing the Seller at closing are disclosed under the heading Adjustments. Examples include the balance in the seller’s reserve account held for an existing loan (if assigned to the borrower(s) in a loan assumption), any rent the borrower would collect after closing for a period prior to closing, and the treatment of any tenant security deposit.

Additionally, the description and amount of any other items owed by the borrower(s) at closing that were not already disclosed in the Loan Costs or Other Costs tables, or Section K must be disclosed. Examples include outstanding real estate property taxes or a principal reduction, as shown in Figure 95.” (pg. 167 – 168)

(Figure 95 even shows a principal reduction being disclosed in Line K.06.)

As a result of this, creditors are in a bit of a conundrum. If they follow The UCD Guide exactly, they would not be complying with the CFPB’s Guide when “other consumer costs” (other than payoffs) are disclosed in Lines K.05 through K.07. If creditors comply with the CFPB’s Guide and disclose all “other consumer costs” in Line K.04, their loan may be rejected by the GSEs for failure to provide an accurate UCD.

Fortunately, the requirements in Regulation Z are flexible enough “on their face” that compliance with either guide is compliant with Regulation Z. But this may not be the case if the CFPB is expecting creditors to comply with their Guide, in which case creditors will have some tough choices to make.

In our system, clients determine which lines they want specific charges to be disclosed in. This provides them the flexibility of choosing which master they wish to follow.