Fannie Mae and Freddie Mac have jointly published a LIBOR Transition Playbook and FAQs to help the housing finance industry transition to SOFR:

https://www.fanniemae.com/portal/funding-the-market/libor/libor-transition.html

http://www.freddiemac.com/about/libor-transition.html

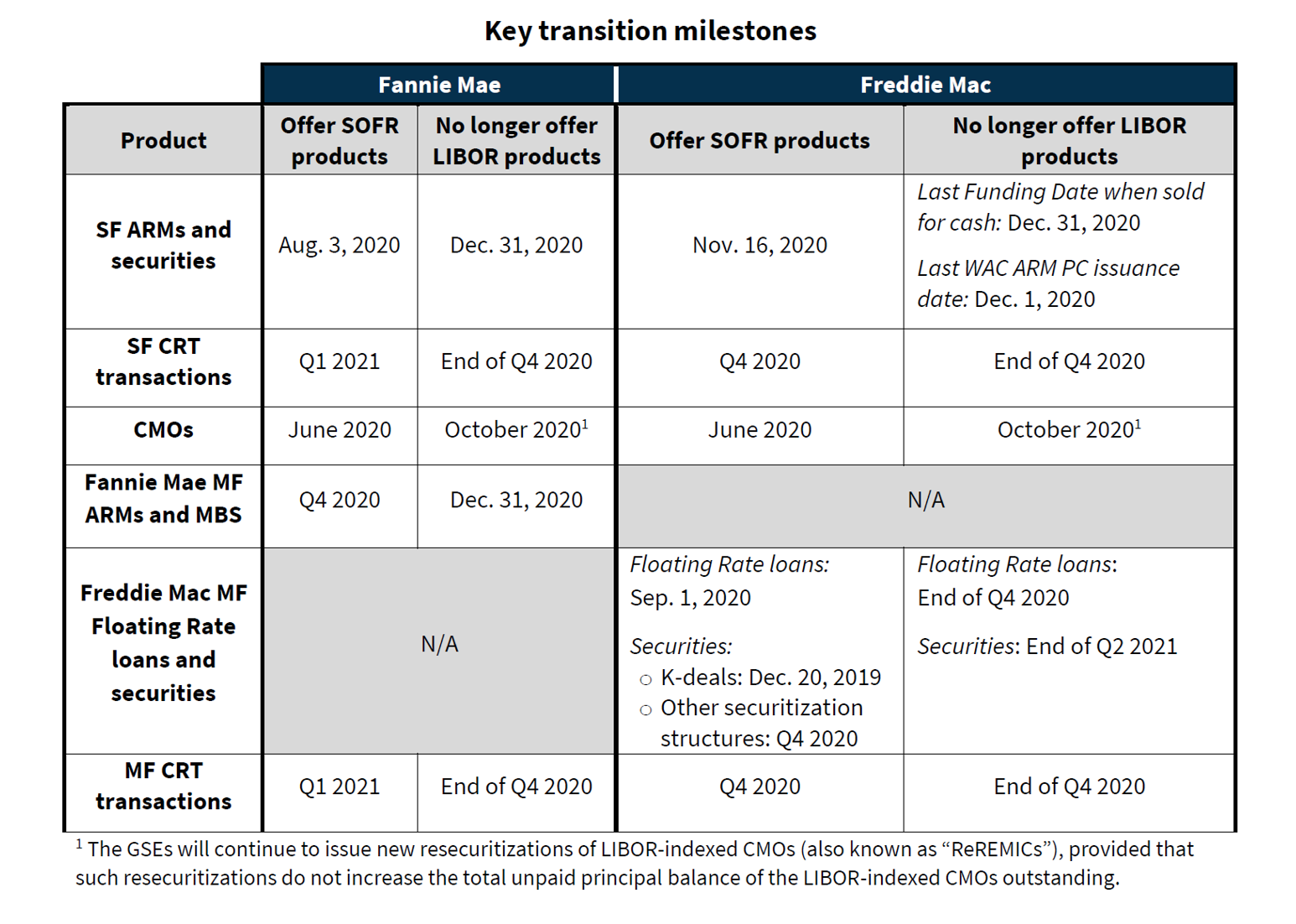

The Playbook includes the following table:

Support has been added to ConformX for the new FNMA/FHLMC SOFR products announced here: https://compliance.docutech.com/2020/04/01/compliance-news-fhlmc-releases-new-sofr-arm-notes-and-arm-riders/.

New SOFR notes, riders, and programs have been created. In addition, several standard forms have been modified to print corresponding text for SOFR loans. The following will print for SOFR loans, depending on context:

- “30-day Average SOFR”

- “SOFR”

- “30-day average cost of borrowing cash overnight collateralized by U.S. Treasury securities (30-day Average SOFR)”

- “published by the Federal Reserve Bank of New York”

New standard SOFR Programs, Notes, and Riders:

New FNMA/FHLMC SOFR programs, notes, and riders have been created in ConformX. Each new program has ARM Index (field 2278) set to “SOFR”.

These two new 3/6 SOFR programs:

-

- FHLM Freddie Mac (FHLMC)

- 3/6 SOFR ARM – 2/1/5 (program 114236)

- FNMA Fannie Mae

- 3/6 SOFR ARM – 2/1/5 (program 114232)

- FHLM Freddie Mac (FHLMC)

Will trigger this new standard note and rider set to print:

-

- 3441 Note ARM 3/6 30-day Average SOFR Index (Cx23830)

- 3141 Rider ARM 3/6 30-day Average SOFR Index (Cx23831)

The rest of the new SOFR programs:

-

- FNMA Fannie Mae

- 5/6 SOFR ARM – 2/1/5 (program 114233)

- 7/6 SOFR ARM – 5/1/5 (program 114234)

- 10/6 SOFR ARM – 5/1/5 (program 114231)

- HomeReady 5/6 SOFR ARM – 2/1/5 (program 114252)

- HomeReady 7/6 SOFR ARM – 5/1/5 (program 114253)

- HomeReady 10/6 SOFR ARM – 5/1/5 (program 114251)

- FHLM Freddie Mac

- 5/6 SOFR ARM – 2/1/5 (program 114237)

- 7/6 SOFR ARM – 5/1/5 (program 114238)

- 10/6 SOFR ARM – 5/1/5 (program 114235)

- Home Possible 5/6 SOFR ARM – 2/1/5 (program 114255)

- Home Possible 7/6 SOFR ARM – 5/1/5 (program 114256)

- Home Possible 10/6 SOFR ARM – 5/1/5 (program 114254)

- FNMA Fannie Mae

Will trigger this new standard note and rider set to print:

-

- 3442 Note ARM 5/6, 7/6, 10/6 30-day Average SOFR Index (Cx23832)

- 3142 Rider ARM 5/6, 7/6, 10/6 30-day Average SOFR Index (Cx23833)

Texas Home Equity

A new TX Home Equity SOFR note and rider set will print in place of the regular SOFR notes and riders when “Is this a Texas Home Equity Section 50(a)(6) loan?” (field 29932) is set to “Yes”:

- TX Home Equity 3442.44 Note ARM 30-day Average SOFR Index (Cx23905)

- TX Home Equity 3142.44 Rider ARM 30-day Average SOFR Index (Cx23906)

The TX Home Equity SOFR note and rider will print for TX Home Equity loans in these programs:

- FNMA 5/6, 7/6, and 10/6 SOFR (3/6 TX Home Equity not offered by FNMA)

- FHLMC 3/6, 5/6, 7/6, and 10/6 SOFR

The following Pre-Closing and Closing global data integrity error has been modified to allow Texas Home Equity loans to proceed for the above types of SOFR programs:

“ConformX does not support Texas Home Equity Section 50 (a)(6) loan documents for this type of ARM loan. In general, only ARM Notes/Riders as posted by FNMA/FHMLC are supported for TX Home Equity loans.”

Multistate Standard Document Edits

Support for the SOFR ARM index has been added to the following multistate forms:

- ARM Disclosure – Investor (Cx13457) The print conditions for Cx13457 have also been modified to add SOFR.

- ARM Disclosure – Lender (Cx14089) The print conditions for Cx14089 have also been modified to add SOFR.

- Changes to Your Mortgage Interest Rate and Payments (Cx17906)

- Pre-Application Estimate (Cx19571)

- Loan Estimate (Cx18565)

- Closing Disclosure (Cx18566)

- Spanish Loan Estimate (Cx18990)

- Spanish Closing Disclosure (Cx18991)

- Closing Worksheet (Cx19349)

- Closing Worksheet 01-01-10 (Cx14226)

State Standard Document Edits

Support for the SOFR ARM index has been added to the following state-specific forms:

- DC Lock-In Agreement (Cx10455)

- DC Mortgage Disclosure Form (THIS FORM MUST BE PRINTED ON RED PAPER) (Cx13354)

- DE Lock-In Agreement (Cx18557)

- FL Interest Rate Lock Agreement (Cx13498)

- GA Lock-In Agreement (Cx15969)

- IA Lock-In Agreement (Cx20841)

- IL Loan Approval Notice (Cx14271)

- IN Lock-In Agreement (Cx18839)

- KS Lock-In Agreement (Cx20858)

- ME Lock-In Agreement (Cx17649)

- MI Lock-In Agreement (Cx17192)

- MN Lock-in Agreement (Cx18228)

- MO Lock-In Agreement (Cx16677)

- NY Lock-In Agreement (Cx5099)

- NY Prevailing Interest Rate Commitment (Cx3710)

- NY Interest Rate Lock Commitment (Cx3588)

- OH ARM Disclosure (Cx13537)

- TX Lock-In Agreement (Cx19606)

- TN Lock-In Agreement (Cx14675)

- VA Lock-In Agreement (Cx14674)

- VT Mortgage Loan Commitment Agreement (Cx4671)

- WA Interest Rate Lock Agreement (Cx2792)

- WI Adjustable Rate Mortgage Information Statement (Cx3951)

Future Plans for Interest Only SOFR

The following new interest only programs and matching notes and riders are currently in development:

-

- 3/6 SOFR ARM Interest Only for 10 Yrs. – 2/1/5

- 10 year IO, 3 year fixed SOFR ARM Note

- 10 year IO, 3 year fixed SOFR ARM Rider

- 3/6 SOFR ARM Interest Only for 10 Yrs. – 2/1/5

-

- 5/6 SOFR ARM Interest Only for 10 Yrs. – 2/1/5

- 7/6 SOFR ARM Interest Only for 10 Yrs. – 5/1/5

- 10 year IO, 5,7 year fixed SOFR ARM Note

- 10 year IO, 5,7 year fixed SOFR ARM Rider

-

- 3/6 SOFR ARM Interest Only for 3 Yrs. – 2/1/5

- 3 year IO, 3 year fixed SOFR ARM Note

- 3 year IO, 3 year fixed SOFR ARM Rider

- 3/6 SOFR ARM Interest Only for 3 Yrs. – 2/1/5

-

- 5/6 SOFR ARM Interest Only for 5 Yrs. – 2/1/5

- 7/6 SOFR ARM Interest Only for 7 Yrs. – 5/1/5

- 10/6 SOFR ARM Interest Only for 10 Yrs. – 5/1/5

- 5,7,10 year IO, 5,7,10 year fixed SOFR ARM Note

- 5,7,10 year IO, 5,7,10 year fixed SOFR ARM Rider

Interest only SOFR programs will be added under CSTM Custom Programs and the corresponding interest only SOFR notes and riders will be provided as standard documents in ConformX. Testing of interest only SOFR on ConformX Stage is estimated to be available July 1, 2020.

The new FNMA/FHLMC SOFR programs and documents, the standard ARM Disclosure print condition changes, and the TX Home Equity data integrity check changes are currently available on ConformX Stage for testing purposes and will be moved to ConformX Production June 6, 2020. The state and multistate standard edits are already on ConformX production. Please note that non-standard forms have not been modified to add support for SOFR. Clients are encouraged to review their non-standard forms for compatibility with SOFR.

If you have any questions or concerns about these changes, please contact Client Support at 1.800.497.3584.

Update: On certain documents, we will be modifying the format of the disclosures of the initial fixed rate period/adjustment period features of SOFR ARMs, to print the abbreviation “mo.” on Federal documents (to match the style used on the Loan Estimate and Closing Disclosure; see 12 C.F.R. Pt. 1026, Supp. I, Paragraph 37[a][10] – 3.ii for details) or “months” for State documents. For example, a SOFR ARM with an initial fixed rate period of three years and adjustment periods of six months would be disclosed as a “3/6 mo.” ARM. These documents are:

- NY Interest Rate Lock Commitment (Cx3588)

- NY Lock-In Agreement (Cx5099)

- ARM Disclosure – Investor (Cx13457)

- FL Interest Rate Lock Agreement (Cx13498)

- ARM Disclosure – Lender (Cx14089)

- WY Commitment/Lock-in Agreement (Cx15904)

Update: An additional change has been made to ARM Disclosure – Investor (Cx13457) and ARM Disclosure – Lender (Cx14089). For 6 month periodic rate adjustment loans, Payment Month Interest Rate First Adjusts – 1 Month (field 101251) will now be used in the subtitle for the fixed period, like is already used for 12 month periodic rate adjustment loans.

This makes a difference for Construction to Permanent loans, since Payment Month Interest Rate First Adjusts – 1 Month will include any fixed rate construction period. The rest of the contents reference the permanent period for Construction to Permanent loans, and will continue to use ARM Fixed Period (field 18204).

For example, if the permanent ARM Fixed Period is 24 months, and the construction fixed period is 12 months, the subtitle will now print “3/6 mo.” even though later in the disclosure “Your permanent loan interest rate can change at the end of two years…” will print.

These updates will take effect on September 29, 2020. Questions or concerns should be directed to Client Support at the telephone number listed above.

DR 314179, 315035, 317489, 319686, DR 329004

TW 286979, 300248

Update: Upon review of our TX Home Equity 3044.1 Deed of Trust (Cx6178), we are making a slight adjustment to the functionality of the Rider section. The FNMA Model form does not have a checkbox for an ARM Rider. Therefore, if an ARM Rider prints we will check the “Other” checkbox, as it is the only checkbox that could be applicable to an ARM Rider. We will check this box for the following documents:

- TX Home Equity 3142.44 Rider ARM 30-day Average SOFR Index (Cx23906)

- TX Home Equity 3183.44 Fixed/Adj. 1 Year Treasury Convertible Rider (Cx7861)

- TX Home Equity 3182.44 Fixed/Adj. 1 Year Treasury Rider (Cx7862)

- TX Home Equity 3176.44 Fixed/Adj. 10 Year Treasury Rider (Cx7863)

These changes will be in effect immediately. If you have any questions or concerns about these changes, please contact Client Support at 1.800.497.3584.

DR 360303