The contact information of the three major credit reporting agencies (Equifax, Experian, and Transunion) is disclosed (as applicable) on the following documents for the following reasons:

- Credit Score Disclosure – A-3/H-3 (Cx15312). This document is a duplicate of the model Forms A-3 (16 C.F.R. Pt. 640, App. A) and H-3 (12 C.F.R. Pt. 1022, App. H) provided pursuant to 15 U.S.C.A. § 1681m(h), 12 C.F.R. § 1022.74(d)(1), and 16 C.F.R. § 640.5(d)(1). The contact information of the agencies appears at the beginning of the form in the “Your Credit Score” section, where the source of the borrower’s credit score is disclosed (there is a separate “How can you obtain a copy of your credit report?” section later in the document, which discloses the contact information for the Annual Credit Report Request Service).

While administrative law does not specifically require the contact information of the credit report agencies to be disclosed, 15 U.S.C.A. § 1681m(h)(5)(D) does require that the form “include the contact information specified by that consumer reporting agency for obtaining such consumer reports (including a toll-free telephone number established by the agency in the case of a consumer reporting agency described in section 1681a(p) of this title).”

- CA Credit Score Disclosure (Cx2112). This document is provided pursuant to Cal. Civ. Code § 1785.15.1(a) and 1785.20.2(a). According to Ibid. § 1785.20.2(d), the required “Notice to the Home Loan Applicant” (of which Cx2112 is a complimentary piece) must include “the name, address, and telephone number of each credit bureau providing a credit score that was used”.

- CA Credit Score Notice (Cx2114). This document is provided pursuant to Cal. Civ. Code § 1785.20.2(d), which requires the notice to include “the name, address, and telephone number of each credit bureau providing a credit score that was used”.

- Statement of Credit Denial, Termination or Change (Cx15858). Provided pursuant to 12 C.F.R. § 1002.9, this document is a duplicate of some of the model forms promulgated in Ibid. Pt. 1002, App. C (Federal Regulation B), which promulgate parts for disclosing the contact information of the agencies. Please note that while Regulation B effectuates the purposes of the Federal Equal Credit Opportunity Act, it is also meant to effectuate certain parts of the Fair Credit Reporting Act (see 12 C.F.R. Pt. 1002, Supp. I, Paragraph 9[b][2] – 9), which requires “the name, address, and telephone number of the consumer reporting agency (including toll-free telephone number established by the agency if the agency compiles and maintains files on consumers on a nationwide basis)” to be disclosed if adverse action is taken on a credit application (15 U.S.C.A. § 1681m[a][3][A]).

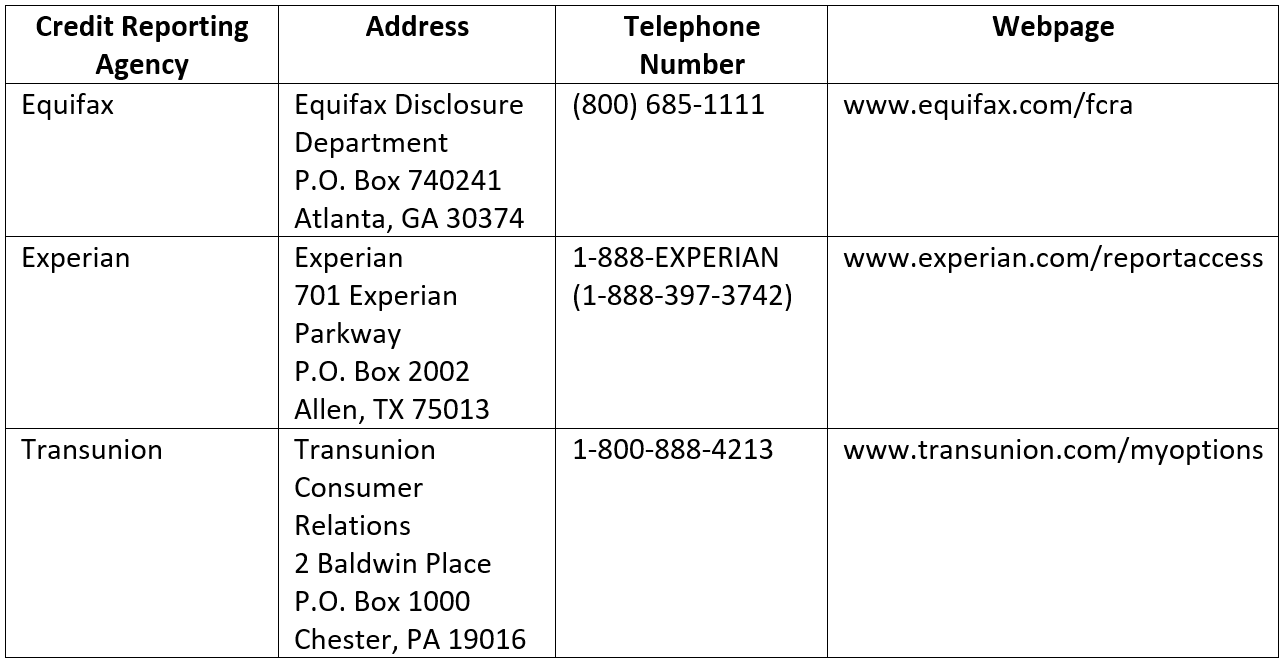

On their websites, all three of the major credit reporting agencies outline the contact information they want consumers to use, should they contact them concerning actions taken under the purview of FCRA and/or the California Consumer Credit Reporting Agencies Act. To wit:

https://www.equifax.com/personal/education/credit/report/how-to-get-your-free-credit-report/

https://www.experian.com/regulatory-compliance/consumer-information/risk-based-pricing-rule

https://www.experian.com/connect/legal/fcra-obligations

https://www.transunion.com/client-support/compliance-notifications

After reviewing this contact information against the information disclosed on our forms, we will be tweaking the above documents so that the contact information perfectly matches that promulgated by the agencies (right now, the information substantively matches). This information is as follows:

These changes will be in effect on August 6, 2020. Questions or concerns should be directed to Client Support at 1.800.497.3584.

DR 324667