There are at least two times in the mortgage documentation process when citizenship is an important factor. One is on a specific section on the 1003 and the other is when deciding if the buyer should be using a W-9 or a W-8BEN. We commonly receive questions regarding the definitions for a citizen, permanent resident and non-permanent resident.

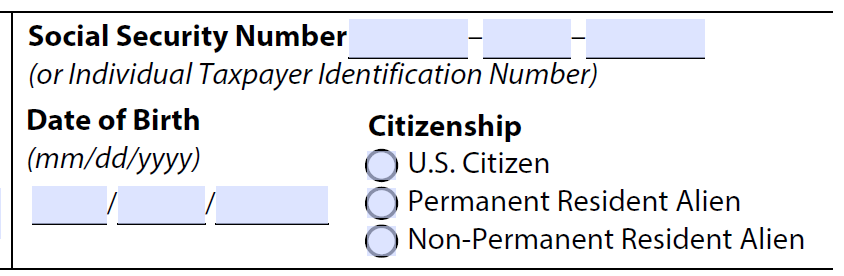

Let’s first take a look at the definitions that Fannie Mae uses in regards to the 1003. On the form, there are the three choices: US Citizen, Permanent Resident, and Non-Permanent Resident.

The DU Specification sheet defines how FNMA differentiates between these three options. The “ReadMe” sheet on the document states the purpose of this section is to provide FNMA lenders and technology solution providers with the necessary information to update their LOS systems with the revised data from the URLA.

Looking at the DU Enumerations sheet there is a form field name called “US Citizen/Permanent Resident Alien/Non-Permanent Resident Alien”. On the same sheet, there is a column called “MISMO v3.4 Enumeration Definition”.

FNMA defines each status under the form field name called “US Citizen/Permanent Resident Alien/Non-Permanent Resident Alien” as follows:

- US Citizen – As defined by the United States Citizenship and Immigration Services, born in the US or its territories; or having a parent who is a US citizen, or naturalized as a US citizen.

- Permanent Resident Alien – As defined by the United States Citizenship and Immigration Services, a non-US Citizen residing in the US under legally recognized and lawfully recorded permanent residence as an immigrant. Also known as “Lawful Permanent Resident,” “Resident Alien Permit Holder,” and “Green Card Holder.”

- Non-Permanent Resident Alien – As defined by the United States Citizenship and Immigration Services, a non-US citizen residing in the US lawfully, who does not have a green card and has not met the substantial presence test required for Permanent Residence status.

Let’s take a look at how the IRS defines a citizen. The FNMA definitions match up mostly with IRS definitions, but there are some nuances. The IRS states the W-9 should be given to those who are U.S. persons. As explained on the W-9 form, the IRS considers you a US person if you are “an individual who is a US citizen or US resident alien”.

The IRS doesn’t ever really define a resident alien, but it does define its opposite, a non-resident alien. The IRS (https://www.irs.gov/individuals/international-taxpayers/taxation-of-nonresident-aliens) defines a non-resident alien as an alien who has not passed the green card test or the substantial presence test.

Conversely, a person would be a US person/resident alien if they either have a green card or pass the substantial presence test. If a person does not have green card or pass the substantial presence test, they are not considered a US person, therefore a W-9 would not be appropriate.

Tying this back to the FNMA citizenship enumerations on the 1003, the choices on the form line up with the IRS designations.

- If they are a US Citizen then that means they are born in the US or its territories; or having a parent who is a US citizen or naturalized as a US citizen and should get the W-9.

- If they are a permanent resident that means they are a non-US Citizen residing in the US under legally recognized and lawfully recorded permanent residence as an immigrant. Also known as “Lawful Permanent Resident,” “Resident Alien Permit Holder,” and “Green Card Holder.”

It is interesting because the definition of permanent resident from the IRS does not include the substantial presence test. However, the definition of non-permanent resident makes it clear that persons who pass the substantial presence test are not considered non-permanent residents.

- They are a non-permanent resident if they are a non-US citizen residing in the US lawfully, who does not have a green card and has not met the substantial presence test required for Permanent Residence status. These people would get a W-8BEN.

Docutech’s goal is to match the guidance from the two different organizations. In order to do this, we have set our standard mappings as follows:

- US Citizens would receive the W-9

- Permanent Resident Aliens would receive the W-9

- Non-Permanent Resident Aliens would receive the W-8BEN.

As the FNMA guidance for the 1003 and the IRS guidance do not exactly match up, clients may feel the need to set up some custom mappings to accommodate their differences in interpretations. If you wish to do so, please contact customer support at 1.800.497.3584.