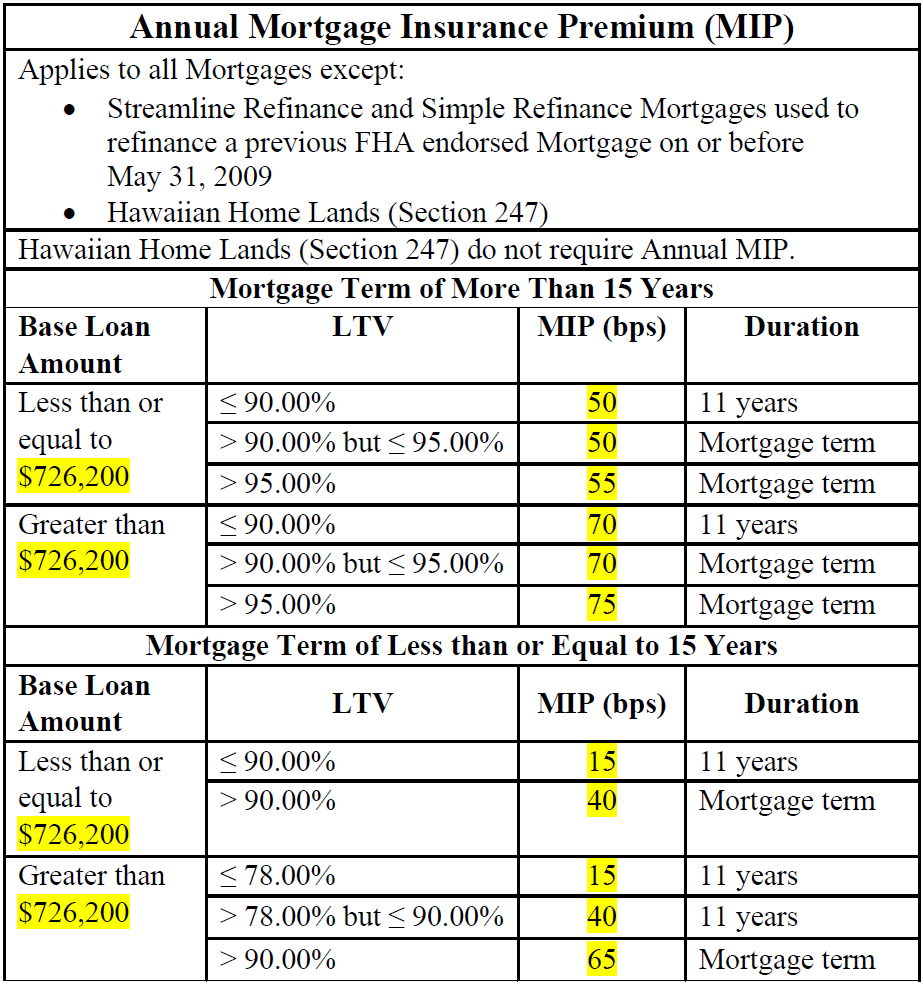

HUD has just issued FHA ML 2023-05 (available at: https://www.hud.gov/program_offices/administration/hudclips/letters/mortgagee), which announces reductions to annual mortgage insurance premium (MIP) rates and modifies the base loan amount threshold used to establish MIP rates to the conforming loan limit. These rates are “effective for case numbers endorsed on or after March 20, 2023”. The Upfront Mortgage Insurance Premium (UFMIP) has not changed.

One unusual aspect of this FHA MIP change is that the rates are for case numbers endorsed on or after March 20, 2023. This is different from the normal process of dating the MIP rate changes for case numbers assigned on or after a specific date. Consequently, we are making a new field that will be used to trigger the application of the new rates, “FHA Case Number Endorsement Date”. This field is in the process of being created, but once we have it created and have an assigned Field Index we will update this announcement with that information so clients and LOSs can prepare to set/send the new field.

Please note that clients attempting to use the new FHA MIP rates immediately may be encountering hard stop Data Integrity Checks that prevent them from proceeding with the new FHA MIP rates. Until our DI Checks are modified with the new rates, clients may turn in a DTX ticket to bypass them by changing the System Default Setting “FHA UFMIP/Annual MIP Data Integrity Check Options” to “None”. We anticipate that it will take a few weeks to have the new Data Integrity Checks in place and will make an announcement when they are ready to test on Stage servers.

We are currently evaluating our systems to determine impact and any further changes. Any changes made will be announced on our website (https://compliance.docutech.com/).

Update: See our announcement here about the changes made.