By: Timothy A. Raty, Regulatory Compliance Specialist

Editing by: Abraham Skousen, Compliance Implementation Analyst

Under the new TILA-RESPA Integrated Disclosures rules (“TRID”), both seller and lender credits are to be disclosed on the Loan Estimate (LE) and the Closing Disclosure (CD). However, there is quite a bit of ambiguity in the industry on how these credits are to be disclosed.

BACKGROUND

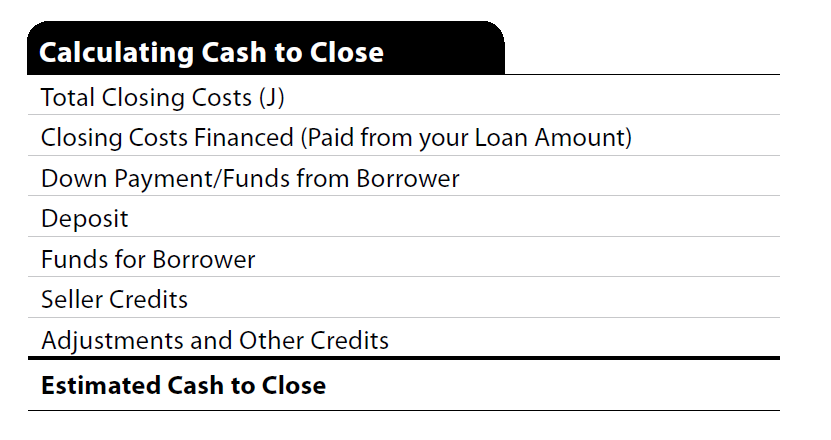

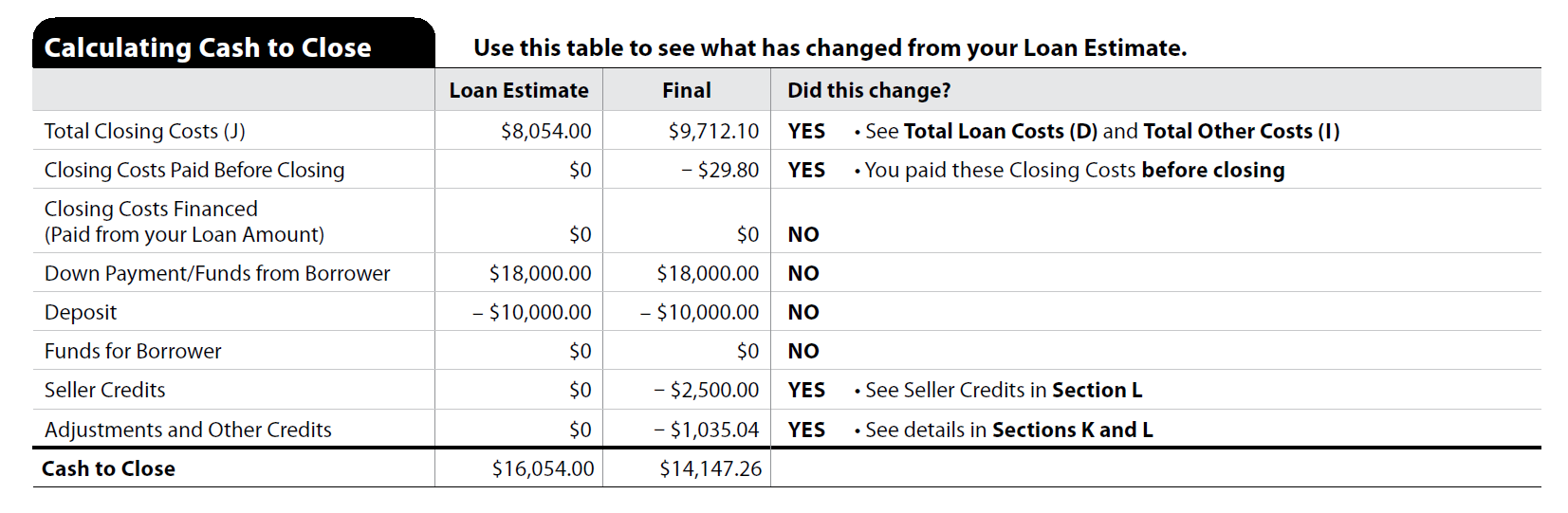

Page 2 of the LE includes a “Calculating Cash to Close” table, which contains a row entitled “Seller Credits” in which the amount of seller credits is disclosed:

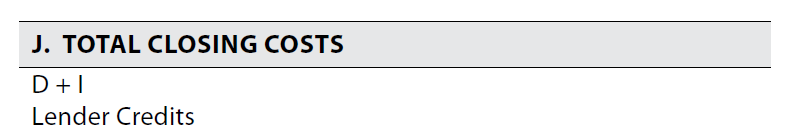

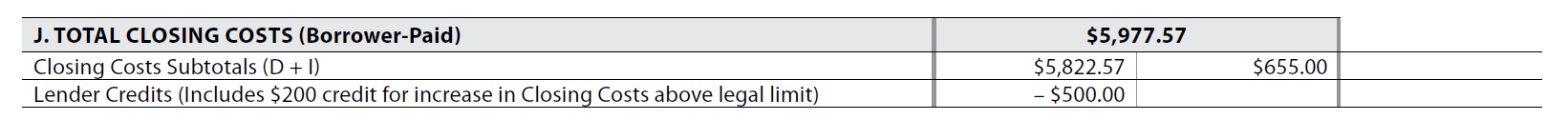

On this same page, under Section (J) (“Total Closing Costs”), there is a row entitled “Lender Credits” in which the amount of lender credits is disclosed:

These are the only two places on the LE in which credits are disclosed. All amounts for fees disclosed in the “Loan Costs” and “Other Costs” tables are attributable to the costs which the consumer will pay (unlike the CD, in which the amounts are disclosed in full and are itemized by payer).

SPECIFIC AND LUMP-SUM CREDITS

Under TRID, the Official Staff Commentaries which accompany it, the analysis for TRID promulgated by the Consumer Financial Protection Bureau (CFPB), and CFPB-published guides on the Integrated Disclosures (collectively referred to as “guides”), TRID distinguishes between two types of credits:

- “Specific” credits attributable to particular fees (g. a $200 lender credit which is applied to a $400 appraisal fee); and

- General or “lump-sum” credits which are not designated towards specific fees (g. a $2,000 seller credit to entice the borrower to purchase the subject property).

Due to these two types of credit, questions have arisen as to whether the amounts disclosed under “Seller Credits” and “Lender Credits” should include:

- An aggregate amount of both types of credits; or

- Only an aggregate of lump-sum credits, with specific credits being factored into the amount of the fee which the credit is attributable to (g. the $200 lender credit for the appraisal is not included in “Lender Credits”, but is subtracted from the total $400 fee, thus leading to a disclose of a $200 appraisal fee to the consumer on the LE).

Unfortunately, the CFPB has not provided clear guidance on how credits are to be disclosed on the LE. Based on the guides, there is no clear, authoritative answer to this question. It is quite possible for LOS partners, clients, and investors to reach different conclusions and have valid, legitimate arguments for such.

For example, guidance which supports disclosing an aggregate amount of all seller credits in the “Seller Credits” row includes the following:

“Seller Credits is the total amount that the seller will pay for items included in the Loan Costs and Other Costs tables, to the extent known, disclosed as a negative number.” (TILA-RESPA Integrated Disclosure Guide to Forms, p. 43, September 2014 Edition; emphasis in original; see also 12 CFR § 1026.37[h][1])

However, there is contradictory guidance which supports disclosing only an aggregate of lump-sum, seller credits in the “Seller Credits” row, and factoring specific seller credits into the disclosed amount of the fees which the credits are attributed towards:

“To the extent known by the creditor at the time of delivery of the Loan Estimate, seller credits for specific items disclosed under [“Loan Costs”] and [“Other Costs”] are represented by the total amount disclosed for those items.” (12 CFR Pt. 1026, Supp. I, Paragraph 37[h][1][vi] – 2; see also 78 FR 79968 [2013])

Even more blatantly contradictory are the guides on lender credits. The following indicates that the aggregate amount of all lender credits should be disclosed in the “Lender Credits” row:

“`Lender credits,’ as identified in [the “Lender Credits” row], represents the sum of non-specific lender credits and specific lender credits. Non-specific lender credits are generalized payments from the creditor to the consumer that do not pay for a particular fee on the [LE]. Specific lender credits are specific payments, such as a credit, rebate, or reimbursement, from a creditor to the consumer to pay for a specific fee. Non-specific lender credits and specific lender credits are negative charges to the consumer. The actual total amount of lender credits, whether specific or non-specific, provided by the creditor that is less than the estimated ‘lender credits’ identified in [the “Lender Credits” row] and disclosed [on the LE] is an increased charge to the consumer for purposes of determining good faith . . .” (12 CFR Pt. 1026, Supp. I, Paragraph 19[e][3][ii] – 5; see also 12 CFR § 1026.37[g][6] and 78 FR 79824 & 79965 [2013]).

Guidance which stipulates that only the aggregate of lump-sum, lender credits should be disclosed, with specific lender credits being factored into the fees which the credit is attributable to, includes the following:

“Lender Credits is the amount of any payments from the creditor to the consumer that do not pay for a particular fee on the Loan Estimate and is disclosed as a negative number.” (TILA-RESPA Integrated Disclosure Guide to Forms, p. 41, September 2014 Edition; emphasis in original; see also 12 CFR Pt. 1026, Supp. I, Paragraphs 19[e][3][i] – 6 & 37[g][6][ii] – 1 and 78 FR 79823 & 79965 [2013])

OUR CONCLUSION

Our conclusion is that these guides are contradictory and that it is possible to arrive at different (but equally valid) conclusions regarding the legal requirements of these regulations. However, it is necessary to take a stance one way or the other, in order to determine how to fill out the Integrated Disclosures by default.

In deciding which stance to take, we have taken the approach which is the most consistent with the regulations governing the content of the CD. The CD re-discloses the initial estimated amounts for items previously disclosed on the LE and compares them with the “final” exact amounts for the same items at consummation. As a result, it is necessary that these amounts be based on the same items, in order to compare “apples to apples.”

To this end, our conclusion is that:

- The amounts disclosed in the credit rows will be the aggregate of the lump-sum credits.

- Amounts for specific credits will be factored into the amounts disclosed for fees which the credits are attributable to.

- If the amount of a specific credit is the same as the attributed fee, then the fee will not be disclosed on the LE (g. if there is a $400 appraisal fee and a $400 lender credit attributed to such fee, the fee will not be disclosed).

- If seller or lender credits are decreased (e. the consumer’s costs increase), such decreases are most likely to occur due to a valid “change of circumstance” and clients should provide a revised LE as a result, to avoid tolerance violations.

Seller Credits Disclosed on the CD

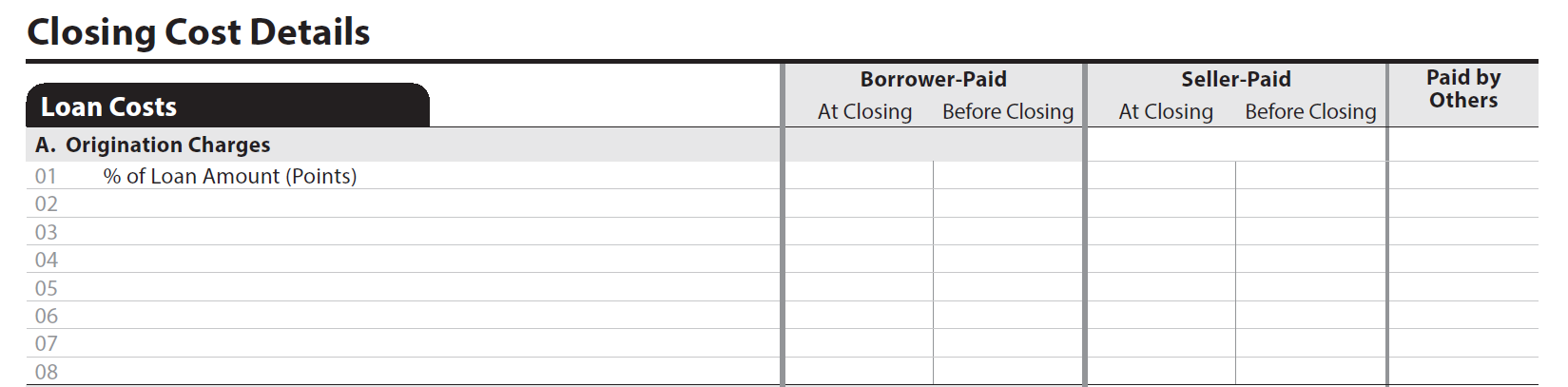

Unlike the LE, fees are itemized on the CD to indicate who the payer of each fee is. Page 2 of the CD provides columns for such itemization, including a column specific to the seller, which indicates what fees or portions of fees (i.e. specific seller credits) that the seller will be paying:

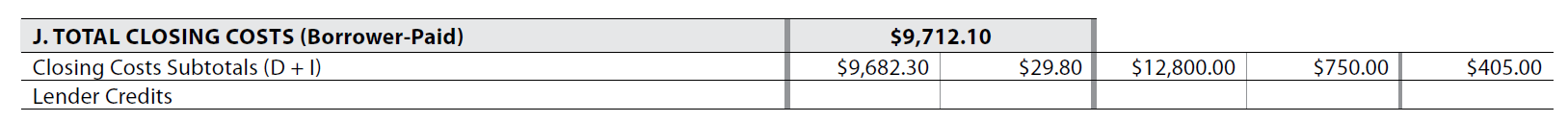

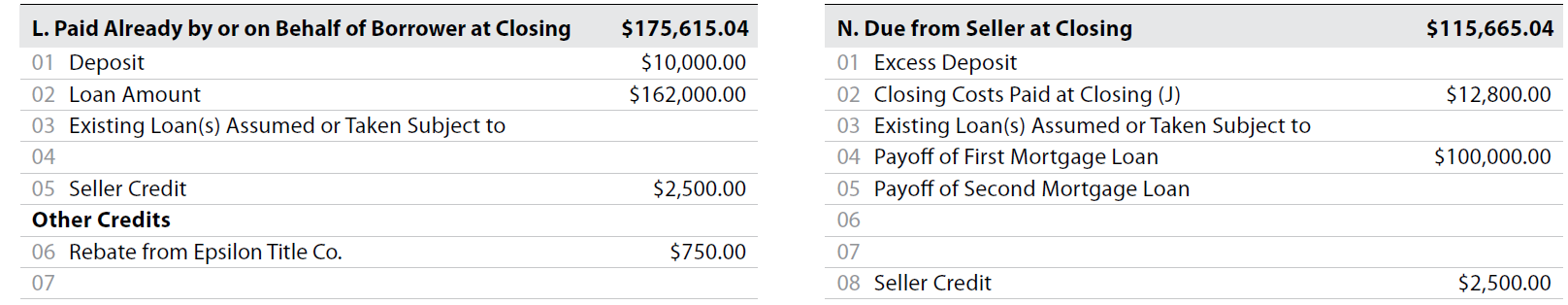

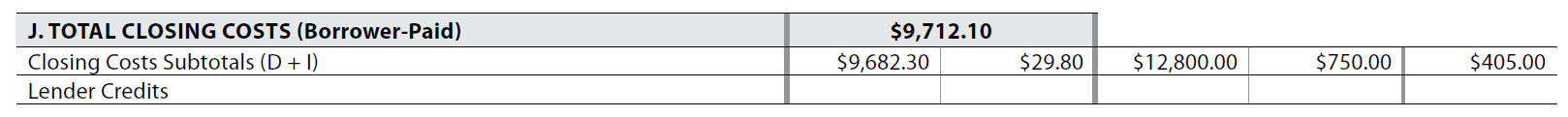

The total sum of these specific seller credits are disclosed in the row entitled “Closing Costs Subtotals (D+I)”, Section (J) “Total Closing Costs (Borrower-Paid)” at the end of page 2:

In addition, similar to page 2 of the LE, the CD contains on page 3 a table entitled “Calculating Cash to Close” which contains a row entitled “Seller Credits”:

This row is broken up into three columns. The first one, entitled “Loan Estimate,” discloses the initial estimated amount which was disclosed in the corresponding row on page 2 of the LE. The second column, entitled “Final,” discloses the final exact amount of seller credits. The third column, entitled “Did this change?” discloses whether these two amounts are different or not and, if they are, a cross-reference to Section (L) (“Paid Already by or on Behalf of Borrower at Closing”), which also discloses seller credits:

The key here is that, unlike the guides to the LE, the guides to the CD are consistent in specifying what amounts should be disclosed as “final” in the “Seller Credits” row. The main regulation states that the “Loan Estimate” column should contain the amounts disclosed in the “Seller Credits” row on the LE. The amount disclosed in the “Final” column should be the same as disclosed in the “Seller Credit” row in Sections L and N of the CD, which is:

“The total amount of money that the seller will provide at the real estate closing as a lump sum not otherwise itemized to pay for loan costs as determined by paragraph (f) of this section [‘Loan Costs’] and other costs as determined by paragraph (g) of this section [‘Other Costs’] and any other obligations of the seller to be paid directly to the consumer, labeled ‘Seller Credit.’” (12 CFR § 1026.38[j][2][v]; see also Ibid. § 1026.38[i][7])

Applicable Official Staff Commentaries are quite clear that only lump-sum, seller credits should be disclosed in the “Calculating Cash to Close” table (see 12 CFR Pt. 1026, Supp. I, Paragraphs 38[i][7][ii] – 1 & [j][2][v] – 1). While it is not clear from the guides to the LE as to what the amount of the seller credits should be in the “Loan Estimate” column, it is clear that the amount disclosed will be compared to the amount disclosed in the “Final” column.

In order to provide accurate information to the consumer, it is necessary to compare “apples to apples” and, thus, the amount in the “Loan Estimate” column should only be the aggregate of lump-sum, seller credits; doing otherwise would create confusion. For example, if the amount in the “Loan Estimate” column is all seller credits, the “Did this Change?” column would almost always indicate that there is a difference between the LE’s seller credits and the CD’s seller credits – and such difference would also almost always indicate that seller credits decreased (since the aggregate amount of all seller credits on the LE would exceed the aggregate amount of all lump sum seller credits on the CD).

A decrease in seller credits would mean that there is an increase in “charge[s] paid by or imposed on the consumer” and would be a tolerance violation, unless a valid “Change of Circumstance” has occurred and a revised LE is issued (see 12 CFR § 1026.19[e][3][i] and 12 CFR Pt. 1026, Supp. I, Paragraph 19[e][3][i] – 5; note that while the Commentary addresses tolerance violations due to a decrease in lender credits, the same principle applies to seller credits).

Lender Credits Disclosed on the CD

Like the LE, there is a “Lender Credits” row in Section (J) (“Total Closing Costs (Borrower-Paid)”):

Note that the last column of this row, which is the “Paid by Others” column, discloses a total of the amounts which are paid by someone other than the borrower and the seller for fees – and can include (more often than not) amounts paid by the creditor (see 12 CFR Pt. 1026, Supp. I, Paragraph 38[f] – 1):

The instructions for the “Lender Credits” row on the CD are set forth in 12 CFR § 1026.38(h)(3).

The Commentary to this subsection states the following (in relevant part):

“When the consumer receives a generalized credit from the creditor for closing costs, the amount of the credit must be disclosed [in the ‘Lender Credits’ row of the CD]. However, if such credit is attributable to a specific loan cost or other cost listed in the Closing Cost Details tables . . . that amount should be reflected in the Paid by Others column in the Closing Cost Details tables under § 1026.38(f) or (g).” (12 CFR Pt. 1026, Supp. I, Paragraph 38[h][3] – 1; see also 78 FR 80013 [2013])