Questions About the Washington Loan Brokerage Agreement (Cx19136)

Feb 9, 2023

A Social Security number (SSN) is a unique number assigned by the Social Security Administration to aid in identification for several purposes, including authorization to work, aiding in tax collection, determining eligibility for government services, and more. Social Security numbers are intended to be a secure means of identification, but care must be taken to prevent fraud and identity theft. For this reason, Form SSA-89, Authorization for the Social Security Administration (SSA) To Release Social Security Number (SSN) Verification, is required to be completed when a third party desires to verify the Social Security number of an individual. For our purposes in the mortgage industry, this is typically a creditor seeking to verify the identity of a mortgage loan applicant.

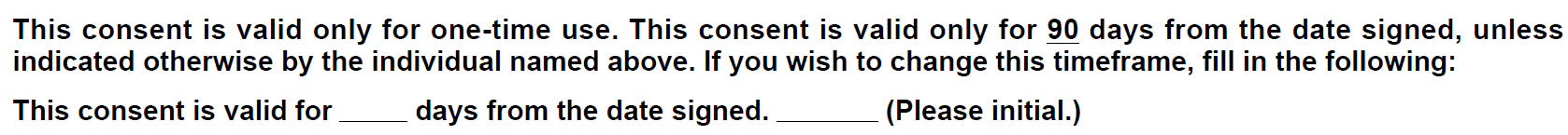

Filling out Form SSA-89 for the purpose of obtaining a mortgage loan appears to be a simple proposition at first glance- a prospective borrower fills out their name, date of birth, and Social Security number, along with the reason they are giving their consent for a creditor to verify their Social Security number with the Social Security Administration. The name and address of the creditor and the creditor’s agent (if applicable) are filled out. Finally, the loan applicant specifies the length of time their consent will be applicable (90 days if not otherwise indicated), and then signs the form, either on their own behalf or as a parent or legal guardian.

Despite the seemingly straightforward nature of the SSA-89, when populating our direct copy of Form SSA-89, Cx5579, there are some considerations that are important to be aware of. The first is that we have included a cover sheet for Cx5579. This coversheet servers a dual purpose: 1) to provide a space for lenders to add barcodes and other clerical information to Form SSA-89, since these additions are not permitted on the form itself, and 2) to satisfy the requirements for “separate disclosure and consent” for eSign, as discussed in previous articles. If field “Prompt for eSign on SSA-89” (FI 154581) is set to “Yes”, new eSign consent text and the option to accept or decline eSign will appear on the coversheet. Users must click “I accept” to be able to proceed with eSigning Form SSA-89, regardless of any other electronic signature consent they may have given elsewhere in the loan process.

Another item to be aware of is that a separate form must be filled out for every reason for authorizing consent. If more than one reason is selected, one copy of Form SSA-89 must be provided for each reason selected. In addition, if the borrower requests to modify the language of the form to clarify their reason for providing consent, lenders need to ensure that a manual process is in place to accommodate that request. This fact is explained on the cover sheet.

One final important thing to note for the SSA-89 is that by default, the consent given on the form is valid for 90 days from the date signed, unless otherwise indicated. There is a section which allows the signer of the form to specify how long the consent is valid for, as follows:

We have had many clients ask for a certain number of days to be hardcoded in this section, or to otherwise prevent the loan applicant from populating an undesired number of consent days. Taking these kinds of actions would not follow the instructions on the form, which state that the change in the consent window must be indicated by the individual named in the form. Lenders should not be hardcoding data into spots on Form SSA-89 that the loan applicant should be filling out. Otherwise attempting to circumvent the ability of the loan applicant to limit the time period for their consent on the SSA-89 should also not be done. An understandable concern is that the prospective borrower might restrict the consent to a number of days that does not allow enough time to complete the loan process. Care should be taken to explain to loan applicants that a reasonable length of time for consent is required before they fill out the SSA-89. In light of these considerations, we will be reaching out to any clients who are currently hard coding a specific number of days into this spot on the SSA-89 to let them know that we view this custom change as a compliance risk.

When properly filled out, the SSA-89 (our cx5579) can be a good tool to properly identify mortgage loan applicants, and can help prevent fraud or abuse of an individual’s Social Security number, as the Social Security Administration intended.

If you have any questions or concerns about our Cx5579, Form SSA-89, Authorization for the Social Security Administration (SSA) To Release Social Security Number (SSN) Verification, please contact Client Support at 1.800.497.3584.

LEG-665

The preceding is for informational purposes only and is not and may not be construed as legal advice. No third-party entity may rely upon anything contained herein when making legal and/or other determinations regarding its practices, and such third party should consult with an attorney prior to embarking upon any specific course of action.